Technology has brought sweeping change to the insurance industry, forcing providers to consider how they can more quickly and effectively deliver services to their customers. Modern technology and tools have changed the game for the insurance industry and more specifically, for the producer channel (see 10 Key Technology Strategies for Insurance Companies).

Socotra asked third party Global Surveyz Research to survey agents and brokers in the US and UK. Their analysis of those results in this report shines a spotlight on a few central themes of importance to global insurers.

Socotra commissioned this survey of 100 full-time employees from insurance agents, independent agents, and insurance brokers in the U.S. and UK, all of whom held senior positions of VP or higher.

All respondents worked with tier 2-5 insurance carriers with up to $5 bn in Direct Written Premiums.

Carriers are now able to develop, launch, and deliver products in a much more nimble and flexible way, and as a result, the expectations of agents and customers have changed for good.

For policyholders, new technologies are about adding convenience across their insurance journey, and for the agent – it’s about optimizing processes and adding automation for a better and faster experience (see Key Benefits of Innovative AI & Machine Learning Technologies).

While the agent/broker/producer channel is challenged by many different forms of distribution available to carriers today (for example, direct- to-consumer and embedded), it remains a significant portion of P&C insurance sales.

Knowing this, Socotra set out to understand what insurers need to know about the challenges agents are facing today, as well as what tools agents are seeking to become more productive and better able to serve their policyholders’ changing needs, and ultimately: how insurers can become the preferred provider for agents in today’s market.

Chief among them is the agent’s need for more automation and simplified workflows through their digital connection to carriers and customers.

Unsurprisingly, agents also indicated the importance of speed to market of new products and investment in technology (while more surprisingly, indicated that commission rates are important, but not key drivers in the agent/ carrier relationship).

Agent business is a critical element of insurer distribution channel

For many carriers, agent business is a critical element of their distribution channel. By adopting agile technology, these carriers have an opportunity to become their agents’ preferred carrier of choice (see Insurers Accelerates Investments in Digital Technologies & Automation Strategies).

Agents recognize that insurance products are complex, and the consequences of policyholders choosing the wrong product can result in their looking elsewhere for a different solution.

The right technology allows agents to offer diverse products delivered in a multi-channel way, and automation that eliminates much of their manual and repetitive work. Without this technology, they are simply unable to effectively retain and renew business.

What agents want, so that carriers can understand how to provide them with the digital capabilities needed to grow their business and give customers the modern digital experience they expect to be selected as their preferred provider.

Socotra asked agents questions like: How do you choose which carriers to partner with? What factors are both driving and inhibiting your adoption of online services? What technology is essential in your day-to-day work?

The results show that agents want to enhance customer experience above all else, even before cost considerations.

As a result, agents will choose to partner with carriers that can solve integration challenges, reduce manual effort, be first to market with new products and technology offerings, and provide intuitive online tools that free up their time to offer better consultation and advice.

Selecting the right technology partner to meet these expectations and needs will help ensure preferred provider status for forward-thinking carriers.

6 Key Findings of Insurance Agents & Brokers Survey

1. The insurance market is maturing, and agents are looking to differentiate their service

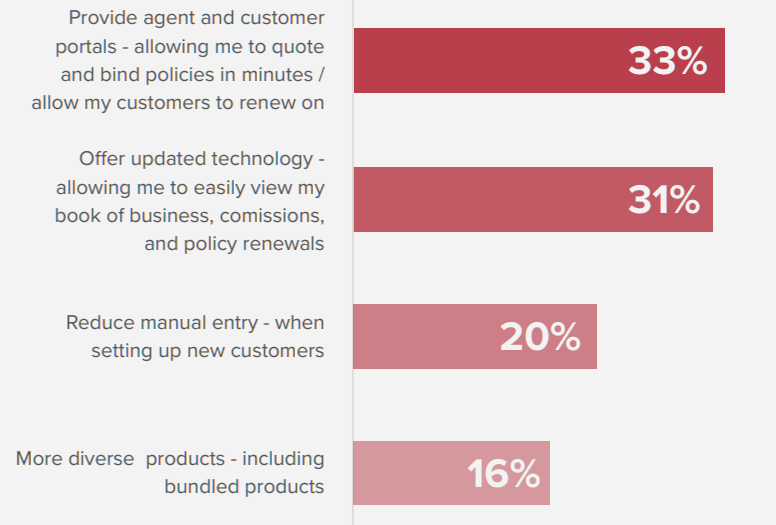

A third of agents would like carriers to provide both an agent and a customer portal in order to support them in increasing their book of business. This marks a shift in the maturity of the industry, where agents recognize technology is critical both for their own back-end processes, and to better serve customer needs.

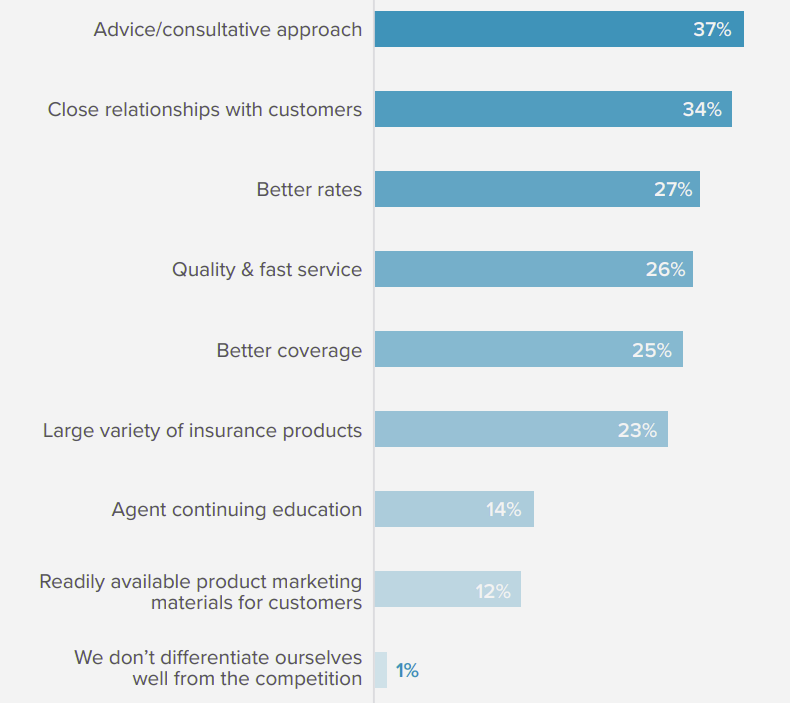

With more time deflected from manual processes, agents are looking to focus on customer service, and cite their main differentiators as providing better advice and consultation, and forming close relationships with clients, both of which come ahead of competing on price.

2. User experience for both the agent and the customer is critical

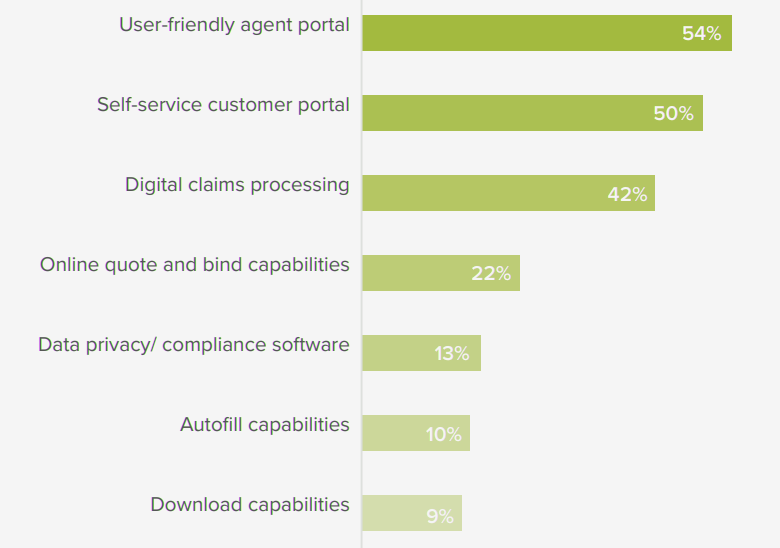

Technology is critical in achieving the goal of better user experience for both the agent and the customer.

Agents rate their most essential technologies as a user-friendly agent portal (54%), a user-friendly customer portal (50%), and the ability to offer digital claims processing (42%).

These tools allow agents to automate manual processes, access better insights, and be increasingly consultative in terms of the advice they can give and how much time they can spend speaking with customers. To access these tools, agents prefer to work with carriers who offer agent and customer portals, multi-channel capabilities including mobile, and automated technology as standard.

3. Commission partnership rates are important, but not the key driver for carrier

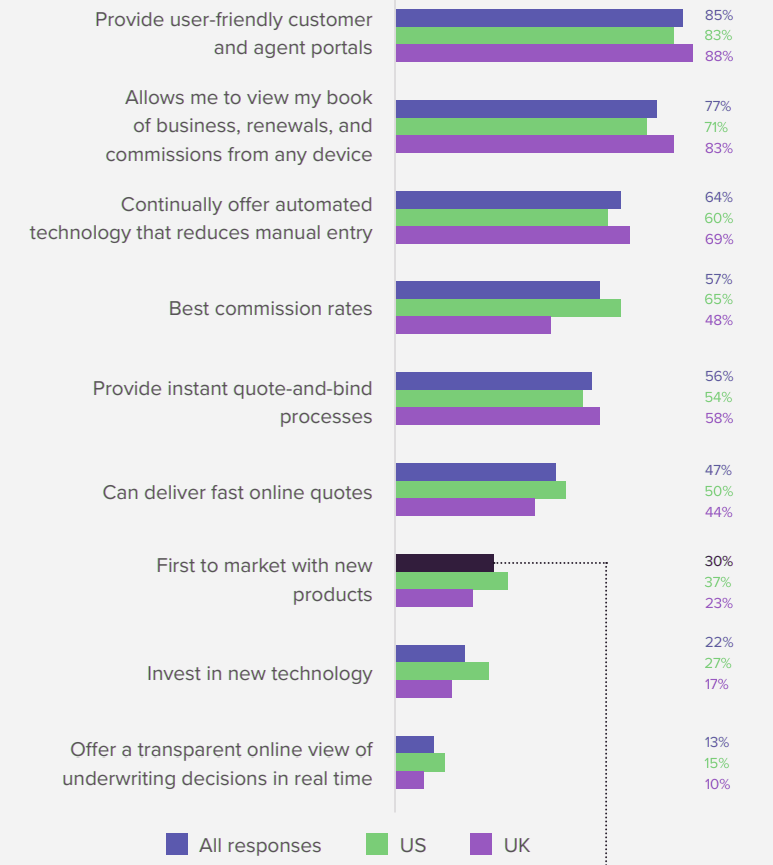

User experience is more important than price, as just 57% of agents cite having the best commission rates as their top consideration when choosing which carriers to partner with. Above commission rates in terms of importance are user-friendly portals, the ability to access information from any device, and the prevalence of automation.

Price is a more important factor for US agents than for those in the UK, at 65% compared with 48%.

Offering better rates to customers is not how agents are differentiating themselves either, with just 27% saying that cost is how they remain competitive against other agents in the market (see How Technologies Will Shape the Future of Autonomous Mobility & Insurance).

4. The more carriers an agent works with, the more important First-to-Market (FTM) becomes

Being first-to-market (FTM) with new products and features is an important consideration for 30% of agents when they are making a decision about which carriers to work with. Not only that, but this number grows exponentially in line with how many carriers they partner with altogether.

Companies that work with 5 or more carriers will consider those who are FTM with new products twice as much as those who work with just 3 or 4 carriers.

Becoming a preferred provider of medium-large agents means putting a focus on modern technologies that can enable you to be quick out of the gate with the latest products.

5. 100% of agents said it was important to quote, bind and deliver a policy online

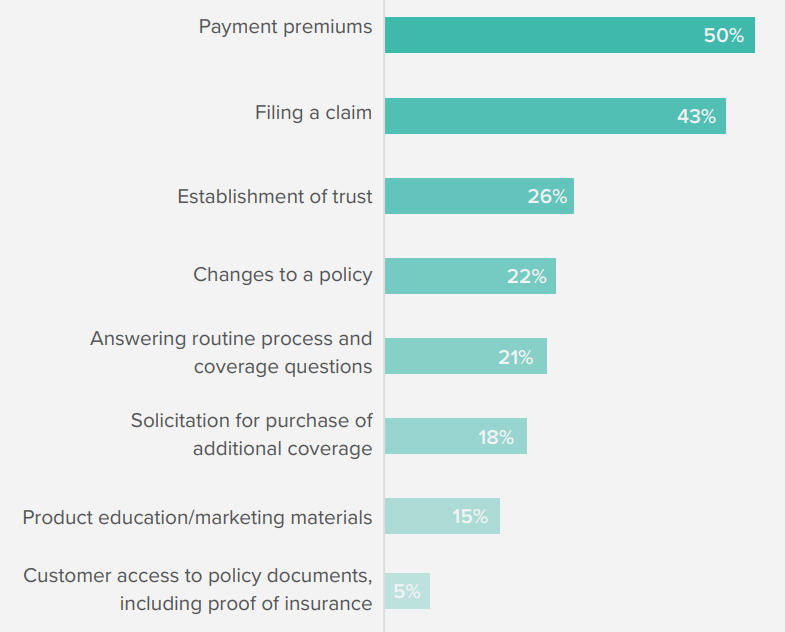

Digital capabilities are critical, but they aren’t all ranked equally in terms of importance. The top elements suited for online are the payment of premiums (50%) and the filing of a claim (43%).

Carriers should consider these digital features table stakes. Inhibitors to offering online services are around data privacy and security, as well as creating a unified experience for customers across different carriers.

As customer experience is so important for agents in differentiating themselves, insurance providers that can make this easy by offering a modern, accessible platform for integration will be more likely to become an agent’s preferred carrier.

6. Offering the capability to view and manage policies in a single place will make you the preferred provider

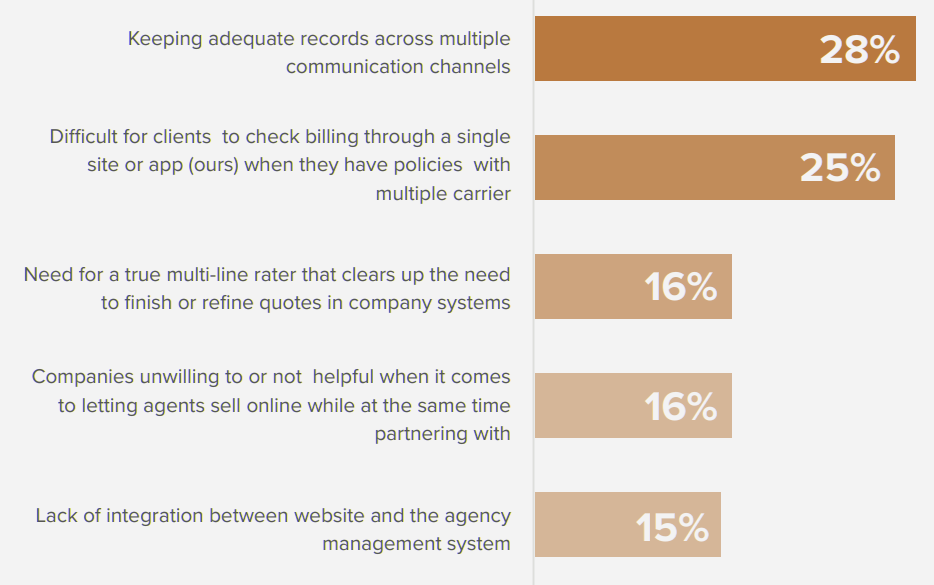

It’s clear that agents are struggling to offer their customers a unified experience. For 28% it’s a real challenge to ensure adequate records across multiple communication channels, and for 25%, providing customers with the ability to check billing for multiple policies cannot be done in a single journey.

To streamline the customer experience, agents may choose to offer a wide range of services via a single carrier, which will help them in sidestepping some of these issues.

However, if a carrier has its own modern portal with easy to integrate APIs, this will make it easier for agents to partner with them. Carriers should consider the advantages of being open and transparent, using a modern platform to encourage agent partnership with their products and services.

How Insurers Can Help to Increase Book of Business?

We asked agents to choose the number one way that carriers could support them in increasing their book of business.

A third of respondents would like both agent and customer portals in place. Agent and customer portals are nothing new in the insurance industry.

They add efficiency to the way agents work, and allow policy holders direct access to view information, and to complete tasks such as renewals. However, this data shows that having modern and effective portals in place, ones which can handle all kinds of business transactions, has become essential in becoming a preferred provider.

Portals are no longer a nice-to-have, and this newfound demand for better visibility to the customer and agent (rather than having a portal simply focused on making things easier for the carrier) is an important step forward in terms of maturity for the insurance industry.

Agents are the trusted advisor to the end-customer, and they believe that being able to provide better access and self-serve capabilities will allow them to catch up to the digital norms.

After all, this is what customers have come to expect across all of their other business interactions, and insurance should be no exception.

Best Ways Carriers Can Help to Increase Book of Business

Technology is critical at both the front end and the back end. Just behind agent and customer portals, 31% of agents cite updated technology as their #1 pick.

They would like this technology to add efficiencies by allowing agents to easily view information on clients, commissions, and policy renewals, and reducing manual entry.

How Producers Differentiate Themselves from Direct Competition?

99% of agents are looking for ways to differentiate themselves from the competition, and relationships are key. 37% say that advice and consultation is their top differentiator, with 34% citing the close relationships they form with their clients. In contrast, better rates are important, but not the deciding factor.

The advent of modern technology facilitates relationship-building, allowing agents to spend less time on manual data entry, and more time on improving relationships with clients.

Unlike many other purchases, where a digital journey may be sufficient, a policy decision is complex, and the stakes are high. While making a decision on personal auto insurance may be simple enough for customers to research online, businesses are different. They often have sophisticated needs and unique constraints.

Ways Producers Differentiate Themselves from Direct Competition

Agents are best placed to provide in-depth consultation and support, and rather than replace the personal touch with technology, they know that they can improve and augment, instead.

Essential Technology Tools

How does digital transformation serve agents in terms of the technology tools that they use?

If you look at the breakdown in responses, you can see that agents are primarily relying on technology to support them in serving the customer, as this is their top priority. For 54% of agents, the top tool is a user-friendly agent portal where they can quickly and easily find information.

Close behind that is the availability of a self-service customer portal (50%), followed by technology that enables digital claims processing (42%).

Respondents also cited that technology moves the needle on internal efficiencies, enabling agents to focus on customer relationships and building their business.

Essential Technology Tools

Considerations for Choosing Carriers to Work With

In a largely commoditized industry, where we have already established that agents are competing on their ability to provide premium service, how can carriers differentiate themselves to agents?

Agents are looking to partner with carriers that can simplify the way that they work and make it more user friendly.

Top of the list is the ability to provide portals for agents and customers (85%), followed by multi-channel visibility and accessibility (77%).

Being able to access their books of business from any device has a meaningful impact on agents’ day-to-day work, as they are often working in a hybrid or remote reality. These top answers, alongside the third response – offering automation, all relate to improving online user experience. It’s interesting to see that commission rates rank lower in the list of considerations, showing that although they are important, CX is more important still.

Almost a third of agents (30%) say that it’s important to be first to market with products, and this number grows depending on how many carriers an agent works with.

Considerations for Choosing Carriers to Work With

Companies that work with five or more carriers are twice as likely to care about time-to-market with new products, as they rely on having a wide range of options to best serve their customers. Interestingly, aside from commission rates which are more important to the U.S. market, there is very little difference between the U.S. and the UK. This means carriers can offer the same technologies between

Elements Suited for Online Agency-Client Services

Agents prefer to collaborate with carriers who allow them to empower the customer with user-friendly online capabilities. This is both valuable for the user, providing a more seamless and accessible experience, and deflects manual effort and repetitive work from the agents so that they can focus on higher value tasks.

As a result, the top two items that Producers say are suited for online are the payment of premiums (50%), and the initial filing of a claim (43%).

Both of these are about allowing the agent to take a step back from routine matters and offering a self-serve alternative through automation.

Biggest Concern about Providing Clients with Online Services

There are many benefits to online services, but that doesn’t mean there isn’t change management involved. We asked agents to share their single greatest concern when considering providing clients with online services.

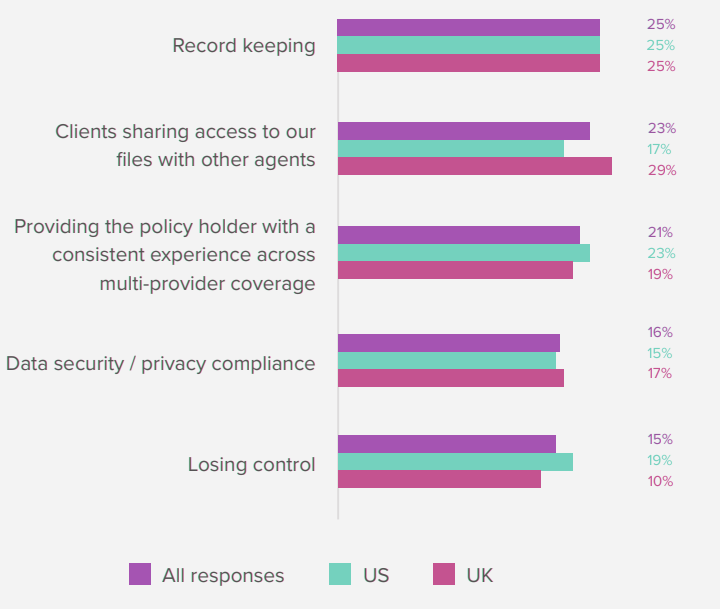

One of the key issues which comes across through the responses is one of data security.

The challenge of record keeping was the largest concern for a quarter of respondents, followed by access control over sensitive information. 16% also specifically cited compliance and data security.

Another key challenge, mentioned by 21% of agents, is providing the policyholder with a consistent, unified experience when coverage is coming from multiple different providers.

The overall question is clear: If an agency is working with different carriers, and each has their own systems and processes – how can they unify your business?

We also dove deeper into the data to see if there are regional differences. Almost 30% of UK agents rank file security and encryption as important, compared with 17% in the U.S. However, both U.S. and UK agents find record keeping important; the ability to view policies from multiple carriers in one place.

Challenges for Producers when Providing Customers with Online Access to Policies

It’s clear that agents are struggling to offer their customers a unified experience. It’s a real challenge to keep adequate records across multiple communication channels (28%), as well as offering customers the ability to check billing for multiple policies in a single place (25%).

It could be that agents will choose to offer a wide range of services through a single carrier to streamline and simplify their customer experience, and sidestep some of these issues.

If a carrier has its own portal with easy to integrate APIs, it makes it easier for agents to do business with this business. It’s therefore to the carrier’s advantage to be more open and transparent, and use a modern platform to encourage agents to partner with your products and services.

Conclusion

The agents have spoken; and they’ve told us that they prioritize customer satisfaction and experience, even above cost considerations.

Smart insurers who recognize how they can help agents delight their policyholders and take the necessary steps to provide both a better agent and customer experience will be better positioned to be selected as an agents’ carrier of choice.

Carriers should consider the advantages of using a flexible, modern platform to automate processes and provide faster speed-to-market for new products in order to build that strong agent partnership with their products and services.

……………..

AUTHORS: Socotra and Global Surveyz Research