The U.S. insurance industry experienced a notable number of layoffs, particularly within the property and casualty, P&C insurance sector. Based on the analysis by S&P Global Market Intelligence, the P&C sector saw a reduction of at least 6,800 jobs.

Approximately 20 different companies in the insurance industry undertook staff reductions throughout the year. This trend was indicative of insurers’ efforts to refocus their core strategies or moderate financial outflows.

Companies cited a variety of reasons for laying off staff, including restructuring in the case of some of the larger reductions initiated by more established insurers.

“For larger carriers, the layoffs were less about conserving cash so that they can survive longer and more about, in some cases, refocusing the business,” according to Kaenan Hertz, managing partner at Insurtech Advisors.

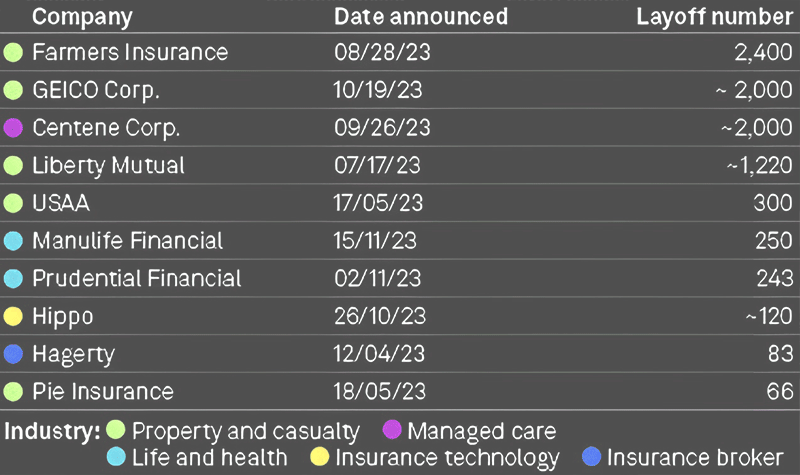

Some of the major companies involved in these layoffs included:

- Farmers Insurance: Farmers made the largest insurance layoff announcement in 2023, parting ways with roughly 2,400 employees, which amounted to 11% of its workforce.

- GEICO: GEICO laid off about 2,000 employees, constituting 6% of its total workforce.

- Liberty Mutual and USAA: Both companies also executed layoffs, though on a smaller scale compared to Farmers and GEICO. Liberty Mutual laid off around 1,200 employees, while USAA cut 300 employees from its workforce.

- Hippo and Hagerty: In a previous report, Hippo was noted to have laid off 120 employees (20% of its workforce), and Hagerty cut 83 jobs in April, representing 4% of its workforce

P&C insurers laid off largest number of employees

Farmers Group laid off the largest number of employees in 2023, announcing in August that it was “parting ways” with approximately 11% of its employees, or about 2,400 people, across all lines of business.

The insurer is seeking to simplify its systems and introduce innovation designed to support the success of Farmers agency owners and employees.

These efforts are part of strategy to reinvent how insurance is delivered and to make us more responsive to the needs of consumers. While difficult, insurer’s decision to become leaner has made us more nimble and has positioned us favorably for future success.

P&C giant Geico announced layoffs, affecting approximately 2,000 people. Although the total number of people affected was similar to Farmers, the percentage of total workforce was lower, with Geico laying off about 6% of its workforce.

Layoffs at the US and Canadian Insurance Insurers

The layoffs at Geico will better position the company for long-term profitability, CEO Todd Combs wrote in a letter to employees.

This will allow us to become more dynamic, agile, and streamline our processes while still serving our customers

Fellow P&C insurers United Services Automobile Association, Liberty Mutual Holding and American International Group were also among the other major P&C insurers to initiate layoffs, although their figures and percentages were lower than Farmers and Geico.

InsurTechs look to stop the burn

Among the insurtechs to lay off employees this year was Hippo Holdings Inc., which announced in October it was laying off approximately 120 employees. As these insurtechs seek to slow down cash burn they often turn to layoffs.

It’s more challenging now to raise capital in the public markets, and all of these insurtechs, whether they are public or whether they are private, they’ve had to lay off staff because that’s really the highest single largest budget line item next to like technology or marketing

Layoffs will likely continue in 2024 but should be smaller and may not hit the threshold needed to report to state regulators or may come in the form of less hiring.

Outside of the P&C space, managed care insurer Centene laid off the largest number of employees, about 2,000 people or 3% of its workforce, amid a challenging time for Medicaid memberships.

Clover Health Investments announced in April that it had laid off approximately 10% of its workforce amid an internal restructuring. The percentage was announced within a release about the insurer’s “business transformation initiatives to accelerate the company’s path to profitability.”

In addition, life insurers Manulife Financial and Prudential Financial each laid off about 250 employees.

………………….

AUTHORS: Tyler Hammel, Rozelle Alyssa Javier – S&P Global Market Intelligence contributors