The UK startup Agio Ratings, specializing in crypto risk analytics, has announced a fundraising round totaling $4.6 mn led by Superscrypt, with additional investments from Portage, MS&AD Ventures, and various angel investors from the insurance and asset management sectors.

Founded in 2022, Agio Ratings offers risk intelligence solutions tailored to firms with digital asset exposure, enabling them to assess and manage risk more effectively.

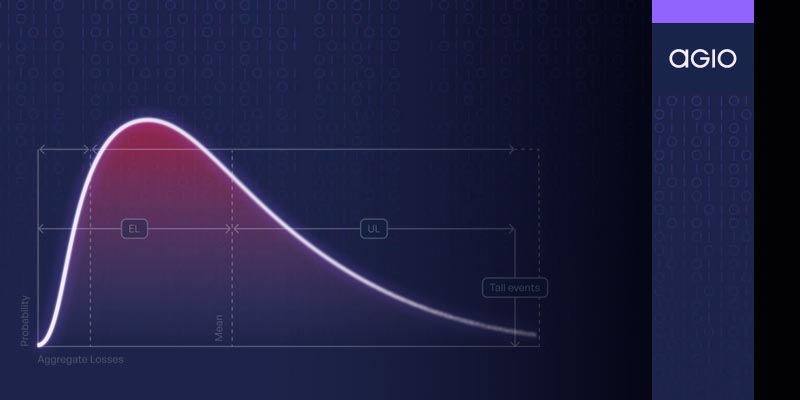

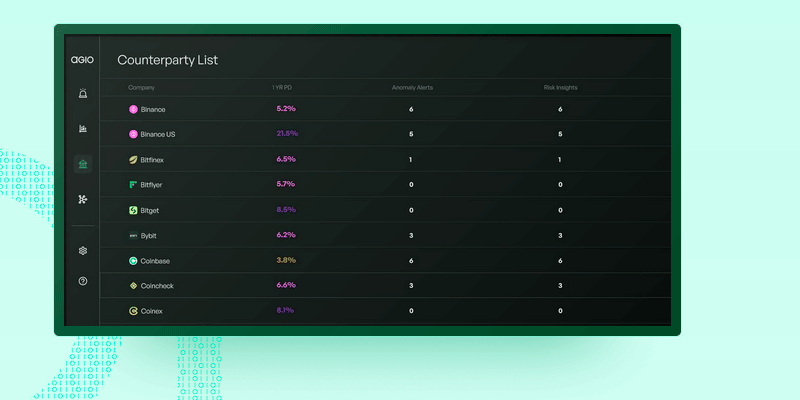

Agio Ratings employs an method to evaluate the default risk among key entities in the digital asset sector, using an extensive database that includes more than 1,000 variables from both on-chain and off-chain sources (see Decentralized Exchanges Risks Review).

This approach allows Agio’s models to offer insights comparable to those from top corporate default risk models in traditional finance.

Ana De Sousa, CEO of Agio Ratings, asserts that digital asset investors need and deserve superior risk analysis tools, a demand that capital allocators and regulators are increasingly making (see Crypto Market Review: Challenging Period for Investing).

She points the gap in the digital asset market for reliable risk data, a gap Agio aims to fill with the support from Superscrypt, Portage, and MS&AD Ventures.

TradFi investors can price risk with help from the large ratings agencies but digital asset investors have no such luck. We are excited to have the support of our investors as we work to become the trusted source of risk analysis for this ecosystem

Ana De Sousa, CEO of Agio Ratings

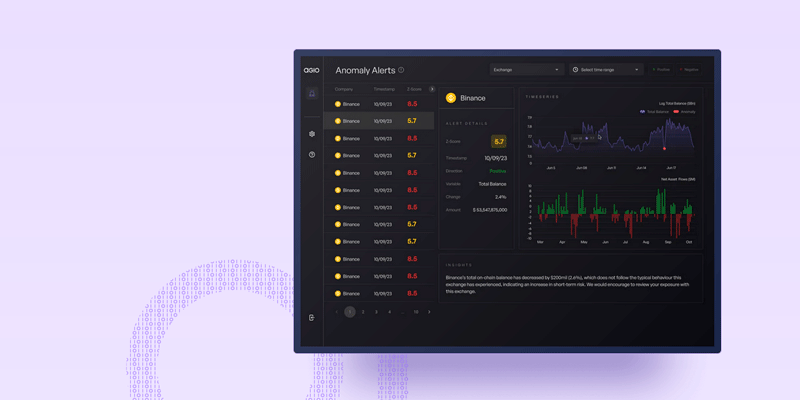

Agio Ratings made headlines in July 2022 by pinpointing FTX as a high-risk exchange through its predictive analytics.

This capability highlights Agio’s dedication to providing detailed risk assessments, aiding clients in confidently and intelligently navigating the digital asset environment.

Following a recent funding round, Agio Ratings plans to further improve its analytical tools and broaden its market presence.

What Agio is building is a critical enabler of greater counterparty transparency and a catalyst for greater institutional participation onchain

Jacob Ko, Partner at Superscrypt

“Beyond helping investors achieve high, risk-adjusted returns, it’s also about unlocking opportunities in credit creation and insurance underwriting which remain largely untapped in the Web3 space”, Jacob Ko says.

Startup Agio Ratings provides comprehensive risk assessments and monitoring, offering tools for capital protection, credit underwriting, and ensuring long-term business success.

by Peter Sonner

by Peter Sonner