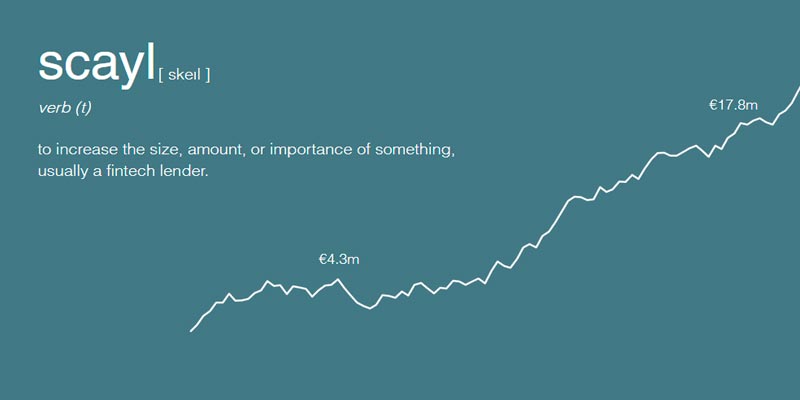

Scayl, a debt financing platform founded by ex-VC, fintech and senior financial services executives, announced its emergence from stealth having raised €100 mn which it will immediately make available for European Fintech lenders (see Biggest FinTech Unicorns).

Dubbed a “fintech for fintech Lenders”, Scayl provides fintechs building credit products with access to transparent funding structures, allowing them to fund their loan books with more flexibility, and 10 times faster than negotiating directly with banks and credit funds.

Previously involved in raising, investing and sourcing billions of euros to fund SME and consumer loans, Medjit Yalmaz, Patrik Blomdahl, and Jatin Goyal, a team of ex-VC, private credit, and fintech lending professionals founded Scayl in 2023, having seen the challenges fintech lenders faced when raising debt (see about Slowdown in FinTech Sector Deals).

By creating a funding product and technology platform built exclusively for fintech lenders, Scayl is hyper-focused on addressing the lack of flexible and cost-efficient debt financing currently available to these companies.

Europe’s worsening macro-economic environment, higher base rates and rising risk of defaults have created an increasingly challenging environment for Fintech lenders to operate in.

This unique combination of obstacles has put pressure on the unit economics of lenders, forcing them to find more flexible and cost-efficient funding – so that they can continue to take advantage of the large market opportunity left open by incumbent banks.

There is a 400 bn euro funding gap in Europe alone, and it will be fintechs, not banks, taking advantage of the opportunity. By supporting these fintechs and helping them fill this gap we expect to facilitate the growth of many unicorns for years to come, and we’re extremely excited by that

Medjit Yalmaz, CEO and Co-founder of Scayl

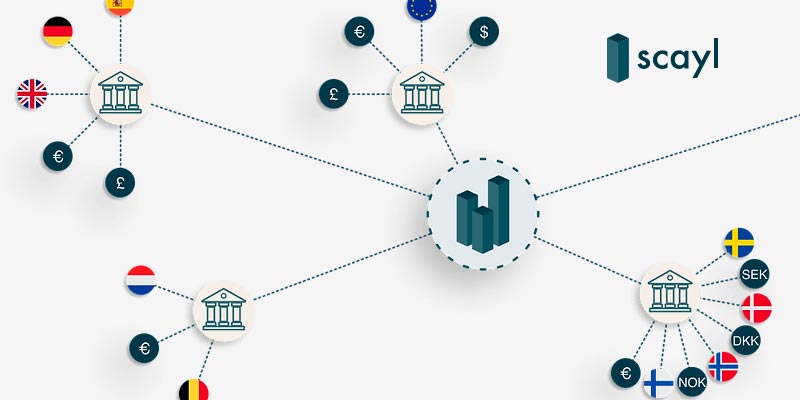

Allowing fintech lenders to seamlessly connect to its platform, Scayl maintains integrations to, and receives funding from, banks and other credit institutions, meanwhile feeding and retrieving all the necessary data required to assess borrowers and facilitate the funding of loans.

The company has developed technology that allows for real-time monitoring of 10,000x more data points and uses AI-enabled risk modelling, rather than traditional approaches currently taken by financiers.

Based on the team’s existing network of banks and fintechs, the company already has interest from nearly 100 lenders across Europe with a total demand of more than €1bn.

Scayl’s product links an ever-growing stable of fintech lenders with a pool of financing partners interested in exposure to SME and consumer credit – allowing fintechs that build credit products to quickly fund their loan book without needing to conduct lengthy negotiations with banks or other credit institutions.

The company has also secured a partnership with a northern European bank to start providing funding for fintech lenders. Scayl will be making these funds available to lenders through its platform.