M&A in the UK insurance industry rose in 2023, in contrast to a wider slowdown in deal activity across Europe, the Middle East and Africa.

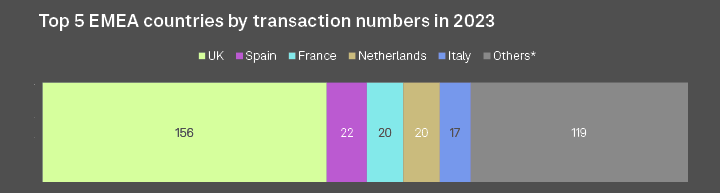

Over the past five years, the United Kingdom has led the EMEA region in M&A activity, achieving more than 100 transactions annually.

This contrasts with other active countries in the region, which usually report deal volumes in the low double digits.

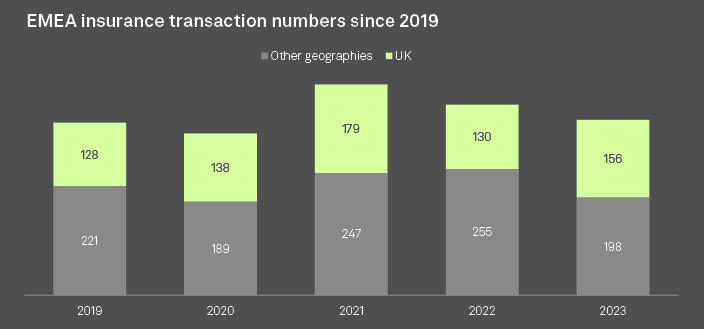

There were 156 acquisitions of UK insurance targets last year, up from 130 in 2022. Deal numbers across EMEA, meanwhile, dropped to 354 from 385 over the same period, largely because deals fell year over year in many of the typically most active countries, including France, Ireland, Spain and Italy, according to S&P Global Market Intelligence data.

The general decline is in keeping with a wider slowdown in insurance M&A activity in other regions across the globe.

The predominance of the UK in this area stems from the M&A activity among brokers. Similar to the situation in the United States, the UK market features a small brokers alongside larger entities pursuing aggressive acquisition strategies to incorporate smaller competitors.

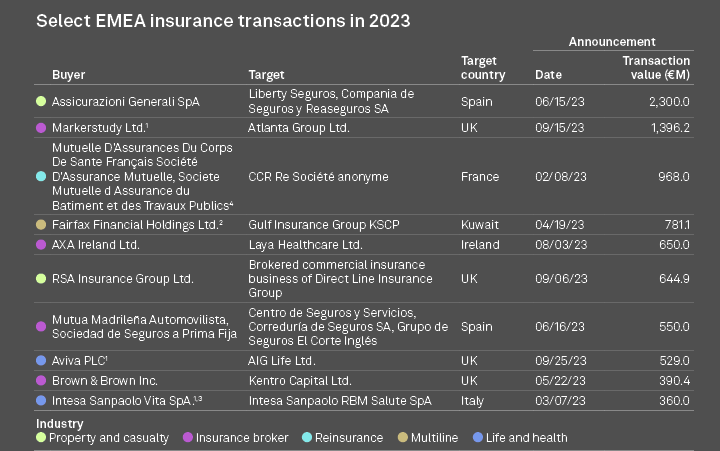

In 2023, one of the most significant transactions by value involved Ardonagh Group Holdings. Ardonagh agreed to sell Atlanta Group, a personal lines brokerage developed through multiple acquisitions, to the UK broker and MGA group Markerstudy.

Although broker transactions were predominant, the UK insurance sector also witnessed several key carrier acquisitions in 2023.

RSA Insurance Group, under the ownership of Canada’s Intact Financial Corp., engaged as both purchaser and seller during the year. It acquired the brokered commercial lines business of Direct Line Insurance Group PLC and sold its UK direct home and pet personal lines business to Admiral Group.

Aviva expanded its portfolio by adding the UK protection business of American International Group Inc. to its recent acquisitions.

While the UK led in deal volume, significant M&A activity was also evident in other countries.

Assicurazioni Generali marked one of the year’s largest transactions with its acquisition of Liberty Mutual’s Spanish operations for €2.3 bn.

France’s state-owned catastrophe reinsurer, Caisse Centrale de Réassurance SA, sold its multiline international reinsurance subsidiary, CCR Re Société anonyme, to a consortium of French mutual insurers.

Although deal numbers across EMEA were down in 2023, they were slightly ahead of 2019, before the COVID-19 pandemic hit.

Early signs indicate that 2024 will be another active year for insurance mergers and acquisitions both in the UK and elsewhere.

Aviva has agreed to buy Lloyd’s of London insurer Probitas Holdings (Bermuda), continuing its bolt-on acquisition strategy.