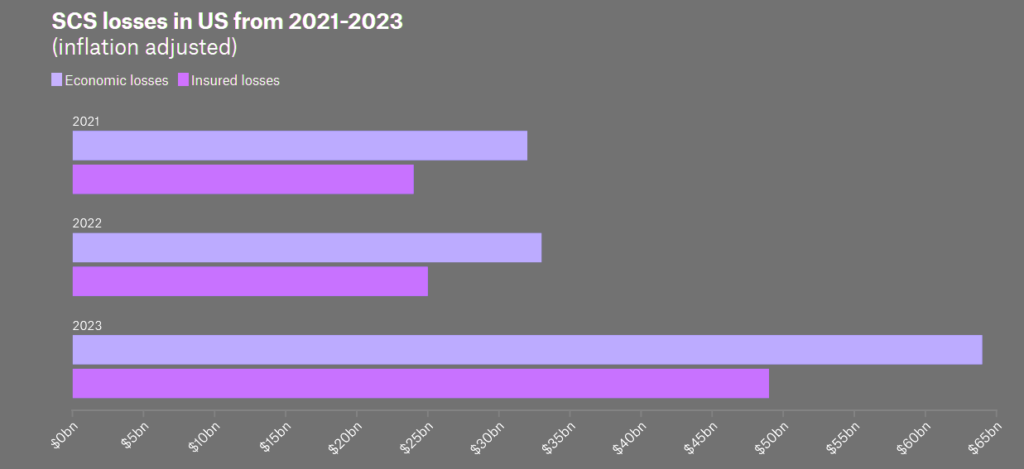

The (re)insurance industry has already faced about $50bn of severe convective storms related losses in 2023, noted Mark Bove, meteorologist and SVP of natural catastrophe solutions at Munich Reinsurance America.

Over the past five years, SCS insured losses averaged around $15bn. There have been spikes in the past, but Bove stated that “2023 is an unprecedented year by far”.

The catastrophe risk specialist noted that severe thunderstorm outbreaks have impacted metropolitan areas repeatedly this year, with several major cities affected by significant hail and/or tornadoes.

The big question for the global insurance industry, and for wider society, is how to better manage the impact of these events.

“Munich Re thinks of risk as the function of three different items – the hazard itself; the number and vulnerability of properties at risk; and the values exposed during these events,” said Mark Bove.

There’s not much we’re able to do about how the hazard is changing.

Society has no control over property values as they are largely a function of macroeconomic trends.

As an industry, we can be a force in accelerating this process through our customer engagement, as well as better terms and conditions that help mutually align our interests in building resiliency

Kevin Johnson, President of Insurance Programs Munich Re Specialty Insurance

It is important when renewing property business to adjust the total insured value to make sure these values are up to date, reflect the true risk being assumed and are priced adequately.

Aside from proper valuation of values at risk, the only variable we can control with respect to SCS losses is improving construction and mitigation.

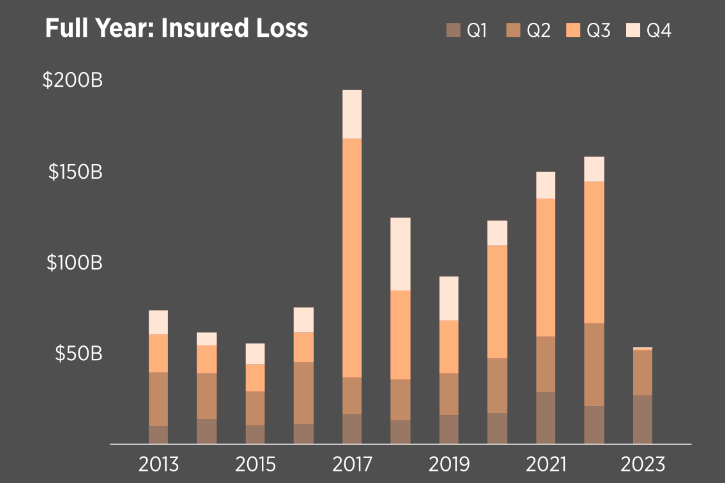

Insured losses by type and perils

In the central US, where tornadoes and straight-line winds are more common, many states have not implemented stronger building codes equivalent to Florida. They also tend to have older building stocks that are more vulnerable to wind.

Some states still do not even have statewide building codes to help protect homes and businesses from SCS-type events

An increase in people living and working in thunderstorm-exposed regions along with greater wealth and higher property values is also pushing losses up.

Loss-drivers of increased SCS losses

90% ↑ in economic losses YOY 2022-2023

Shifting weather patterns have seen tornado activity move east into more densely populated areas, again pushing up losses. To address these changes, insurers should look to re-evaluate cat models, coverages, retention limits and their risk accumulation appetites.

While progress is being made to improve resiliency, more work still needs to be done.

“Every new catastrophe event provides new evidence of the benefits of building to the Institute for Business and Home Safety’s FORTIFIED building standards, reducing the number of damaged homes and displaced families after an event, leading to faster community recovery. The impressive performance of FORTIFIED properties helps get the message out,” said Bove.

“For older structures, a full retrofit may be too expensive, but there are simple, relatively inexpensive steps people can take to help increase the odds that their home or business survives,” he added.

As an industry, it’s important that all stakeholders address and mitigate natural catastrophe risk to maintain a sustainable, profitable property insurance market, the executives said.

by Nataly Kramer

by Nataly Kramer