Insurtech Verikai, a provider of predictive analytics and AI-powered solutions for the insurance industry, has released of its platform.

The new platform combines powerful data-driven risk assessment insights within a user-friendly digital portal, revolutionizing the end-to-end underwriting experience for insurance companies.

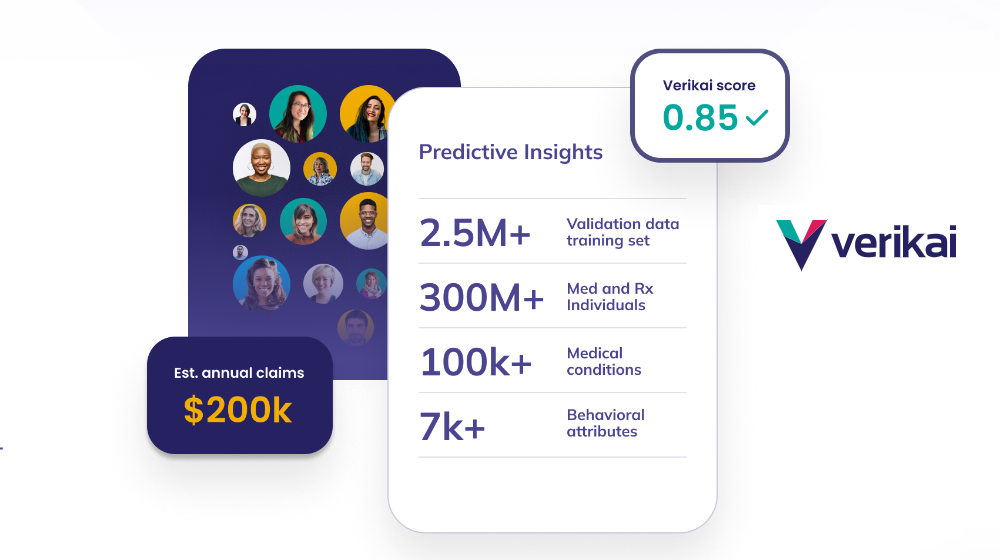

By harnessing the potential of Verikai’s predictive risk models, constructed on an extensive database of behavioral and medical data, the Verikai platform offers an unparalleled 360-degree view of risk.

Seamlessly integrating with existing quoting and policy management systems, Verikai empowers underwriting teams to respond to RFPs efficiently, with the potential to dramatically reducing loss ratios through targeted risk analysis.

This revolutionary platform consolidates previously separate offerings, including risk scoring, medical and prescription history analysis, and a digital portal for RFP submissions.

Our mission has always been to equip insurers with cutting-edge predictive AI and technology. This groundbreaking platform is a significant stride toward realizing that goal

Paul Stock, President of Verikai

The platform boasts an industry-leading interface, offering an intuitive user experience and unparalleled accessibility. Equipped with groundbreaking predictive insights, insurance professionals can effortlessly review critical medical and pharmaceutical claims, conduct comprehensive risk assessments, and secure more business.

Verikai is transforming insurance companies and empowering underwriters with AI-assisted decision-making.

As a pioneer in predictive analytics and AI-powered solutions for the insurance industry, Verikai continues to push boundaries and set new standards.

With the Verikai platform, insurers can streamline their operations, enhance efficiency, and unlock unprecedented growth opportunities.

Verikai’s cutting-edge technology provides insurers with unprecedented insights into behaviors that drive change. With Verikai, insurers can enhance their underwriting process, reduce loss ratio, and grow more profitably.