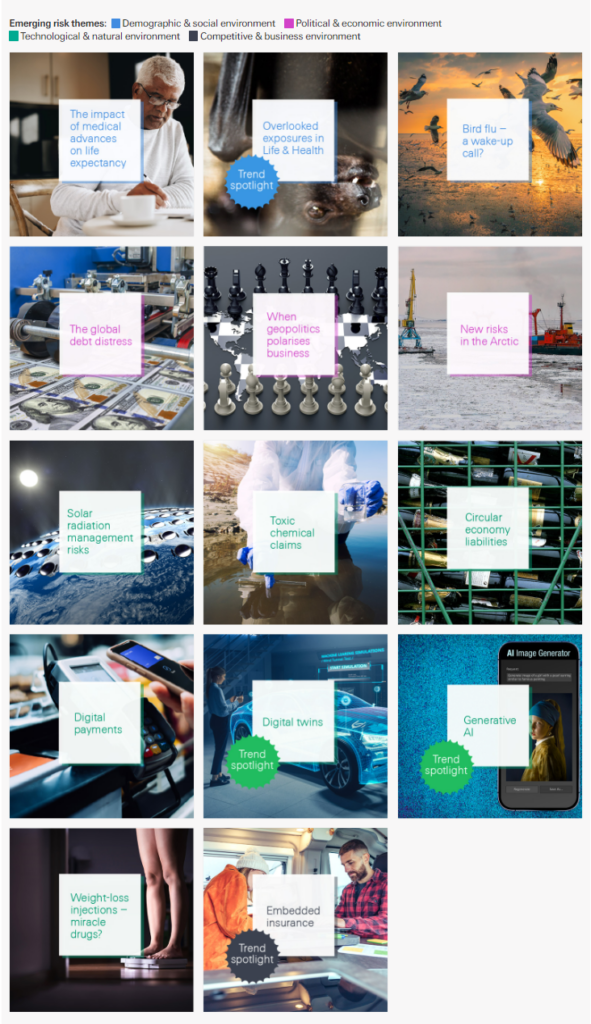

This year’s emerging risk insights reflect the uncertainty currently shaping the global risk landscape of the insurance industry, including geopolitical tensions, volatile financial markets and technological innovations such as generative AI.

The 11th edition of Swiss Re’s SONAR report reveals that the threats on the horizon develop as dynamically as the technological, geopolitical and social changes in the world today.

Swiss Re’s 2023 SONAR report covers 17 new risks and trends across technological, economic, social and environmental areas

Geopolitical tensions and financial market volatility persist in the post-pandemic world marked by the war in Ukraine, rising interest rates and inflation. In parallel, global polarisation and conflict may give rise to mutually exclusive markets (see New Era of Insurance Claims Management and Customers Experience).

Even the risk of nuclear events is heightened. Inflationary pressures bring into question the sustainability of sovereign debt across the globe. The threat of a new pandemic still looms. The recent outbreaks of Avian influenza are the largest to date, in different parts of the world.

Emerging risk in the technology space

One key emerging risk identified in the SONAR report that spans across technological, economic, social and environmental issues is the “Arctic opening”.

Another emerging risk in the technology space could derive from complex machine learning systems and artificial intelligence (see How Artificial Intelligence Can Help Insurers Reduce the Inflation Impact?). These two high-impact areas are driving the next wave of technological advance.

Through the use of AI in insurance claims management, an automated claims processing workflow can optimize human-in-the-loop processes, speed processing times, mitigate fraud, and enhance the customer experience.

As AI use increases, so do the possible risks. Professional hackers can not only trick models into making mistakes or leaking information, they can also harm model performance by corrupting training data or stealing and extracting machine learning models.

The SONAR report emphasises how the rise of AI is increasing opportunities for fraud and intellectual property loss, such as phoney creditworthiness ratings or false insurance scores (see How Does AI Technology Impact on Insurance Industry?).

In car insurance, AI-based insurance claims management systems may even be tricked into seeing massive damage where there is none.

If AI gets hacked, it could even result in physical harm by causing autonomous car crashes or medical misdiagnoses.

Computer vision models help insurance claims adjusters

Computer vision is the technique by which AI models can derive meaning from visual inputs such as images and videos.

Computer vision models help claims adjusters by analyzing geospatial information (GIS) collected from satellites and videos or images captured by customers or drones.

For example, insurtech companies are using drones equipped with computer vision technology to instantly assess damage to cars, factories, homes, disasters, etc.

Advanced analytics are good at detecting and preventing fraud. The FBI estimates that fraudulent claims cost more than $40 billion annually in the U.S. alone. As a result, it is a burden on insurers, forcing them to raise premium prices.

Traditionally, insurers manually check the relevance of claims to determine whether they are fraudulent or not. This has been a time-consuming and inefficient process. For instance, according to McKinsey, for every 10 health insurance claims submitted, insurers classify up to 7 as unusual, meaning potentially false or fraudulent, based on company policy. Re-investigating 70% of claims is an unrealistic suspicion rate that shows that people are not effective fraud detectors.

An example of automated, AI-enabled claims processing

Imagine, for instance, that your company offers vehicle insurance. One of your customers just got into a fender bender. Fortunately, no one is injured.

An onboard telematics device automatically sends data to your system because it suspects the crash—maybe it sends speed, travel direction, area of impact, damage severity, and an initial damage assessment.

The system also automatically texts your customer using a chatbot, asking them to confirm the incident and guiding them to upload photos and videos when it’s safe to do so.

This data runs through your predictive analytics and advanced automation systems to predict whether human intervention is needed or if the claim can proceed.

If so, a machine learning model uses the uploaded photos to estimate damages. The chatbot then recommends the nearest repair shop and lets the customer know you’ll issue payment immediately.

Technological innovations impact society and business

Technological advances continue to drive societal and economic change. The spread of the digital economy offers new opportunities for insurers, such as embedded insurance or cost savings in product testing, design and maintenance with the integration of digital twins. But the expanding use of machine learning systems will expose more services to potential flaws and manipulation. Increased digitalisation of various services, such as growing reliance on digital payments, brings about new vulnerabilities of power shortages and cyberattacks that may paralyse large sectors of the economy. Digitalisation also raises questions around ownership and liability, as is the case with the rise of generative artificial intelligence.

New risks from advances in health and environmental concerns

Growing concerns around the mental health impacts from addictive online platforms are putting liability pressure on social media platform providers. Medical innovations in drug development and care technology make it more difficult to predict mortality and morbidity trends. While life expectancy among a rapidly ageing population is growing, healthy life expectancy is not increasing at the same pace.

New risks arise from toxic chemicals introduced decades ago that are now being scrutinised for their potential to harm people and the environment.

The need to reduce pollution and resource depletion in the future is accelerating the circular economy. But new liabilities emerge as businesses need to rethink entire logistics concepts to promote sustainable recycling.

Other new emerging risks include dangers from solar radiation management, which aims to reverse climate change, and the unknown long-term health risks from weight-loss injections that are intended to manage obesity but are becoming popular for aesthetic use in non-overweight people as well.

Future threats include malicious attacks on artificial intelligence systems, potential clashes over new trading routes in the Arctic and the dangers of using technology to cool the earth

From the opening-up of previously frozen waterways in the Arctic to hackers tampering with artificial intelligence, the emerging risk landscape is multi-faceted.

As the Arctic Ocean and adjacent land are warming up two to three times faster than the rest of the globe, the ice is melting, and new shortcut shipping routes are opening up.

However, the area is a hotspot for potential geopolitical tension, provoking concerns over how economic activities and related risks will be controlled in the region.

The concurrent increases in economic interests, environmental change and geopolitical tensions make the Arctic a hotbed for emerging risks and potential risk accumulation.

With SONAR, we aim to proactively engage our clients and industry stakeholders in discussion of emerging risks, as we find this is the best way to be prepared.

Patrick Raaflaub, Swiss Re’s Group Chief Risk Officer

A more futuristic but potentially significant risk examined by SONAR is solar radiation management (SRM) technology, which could be used to cool the earth. While this does not address the root cause of global warming, namely greenhouse gas emissions, it could help lower global temperatures.

However, techniques such as injecting highly reflective particles into the atmosphere to reflect sunlight back into space could open up a whole new set of environmental risks and the potential for international conflicts.

If implemented and then suddenly terminated, the result of SRM could be fast temperature increases, bringing on related weather effects. It could lead to an increase or geographical shift of extreme weather events like droughts or hurricanes. The question would be how to compensate those experiencing negative effects.

by

by