In addition to monitoring potential systemic risk arising from insurance sector-wide trends related to specific activities and exposures, the Global Monitoring Exercise (GME) includes an assessment of the possible concentration of systemic risks at an individual insurer level arising from these activities and exposures through the internatonal insurance market. Beinsure Media selected the key points of the IAIS’ report.

This section covers public disclosures on specific aspects of the market, as outlined of the GME document.

IAIS analysis of aggregate trends in the insurer pool

According to Global Insurance Market, the IAIS performed trend analysis on data from the Insurer Pool and used the outcomes for the overall assessment of the possible concentration and evolution of systemic risk at the level of the individual insurers.

Trend analysis includes developments in denominators, drivers of those developments, identification of outliers and data issues, and the impact of foreign exchange rates or sample fluctuations.

Trend analysis also covers a comparison of individual insurers versus Insurer Pool developments. Sample controls are applied to keep the sample stable over time.

The GME includes an assessment of the possible concentration of systemic risks at an individual insurer level. The assessment of climate-related risks in the insurance sector shows that insurers globally maintained significant exposure to climate-related assets, with insurers continuing to allocate substantial portions of their investment portfolios to climate-relevant sectors, exposing themselves to transition risk.

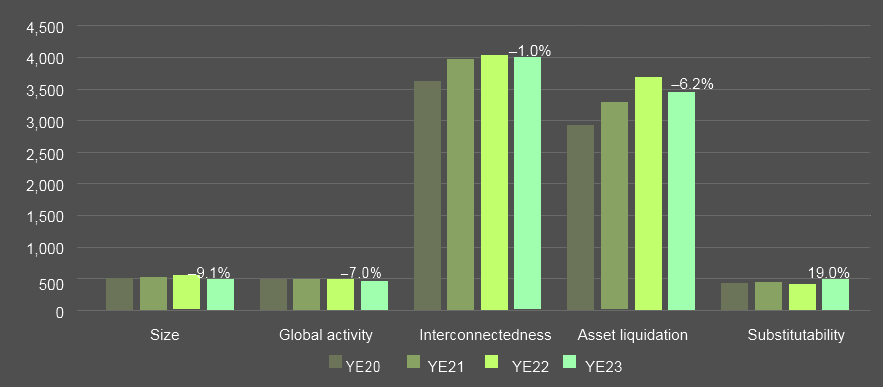

For the Insurer Pool, the aggregate systemic risk score has decreased by 3.1% at 2023. Key drivers for this were decreases in the systemic risk categories of size (-9.1%), global activity (-7%) and asset liquidation (-6.2%). The substitutability category increased year-over-year, driven by increases in GWP for specific lines of business such as aviation and marine coverage.

Systemic risk categories’ scores in bps

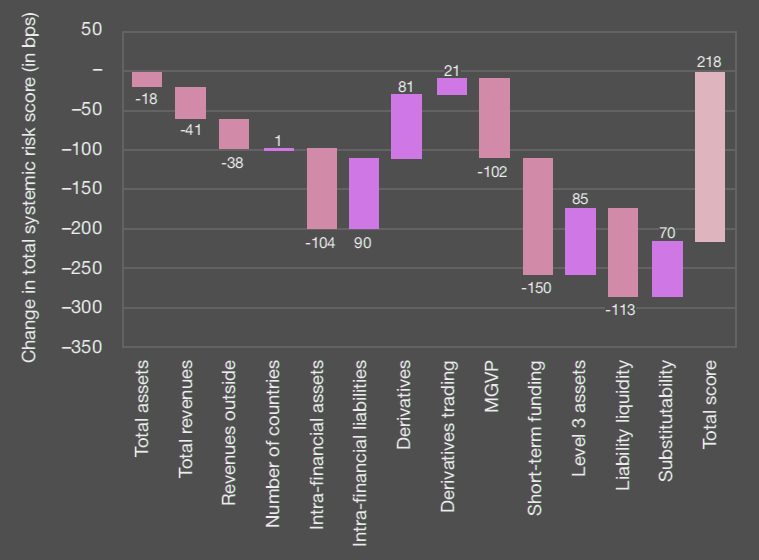

Looking at the breakdown of total systemic risk score changes by systemic risk indicator, key drivers for these declines are the decrease in short-term funding (-150 basis points), liability liquidity (-113 basis points), intra-financial assets (-104 basis points) and minimum guarantees on variable products (-102 basis points).

The declines were partially offset by increases in intra-financial liabilities (90 basis points), level 3 assets (85 basis points), derivatives (81 basis points) and premiums for specific business lines (substitutability) (70 basis points).

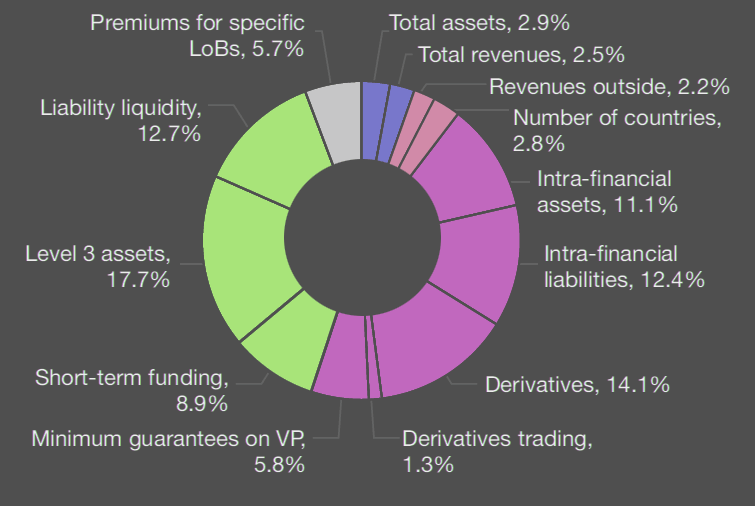

On aggregate, the most material systemic risk indicators are level 3 assets (accounting for 17.7% of the total systemic risk score), derivatives (14.1%), liability liquidity (12.7%), intra-financial liabilities (12.4%) and intra-financial assets (11.1%)

Total systemic risk score changes

Share of systemic risk indicators in total score

Insurance and banks cross-sectoral analysis

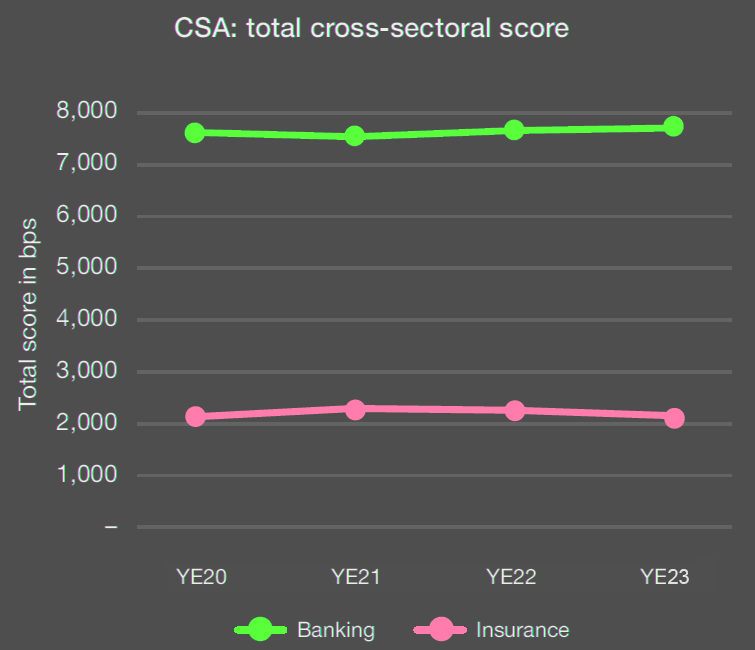

Cross-sectoral analysis (CSA) is performed to compare the systemic footprint of insurers with banks using a systemic risk scoring methodology based on indicators that are common to both the Global Systemically Important Bank methodology developed by the Basel Committee on Banking Supervision (BCBS) and the IAIS’ IIM methodology.

The cross-sectoral methodology was developed by the joint IAIS-BCBS Task Force on Banks and Insurers.

Keeping the pool of banks and insurers stable over time, the total cross-sectoral scores for banks are still significantly higher than for insurers.

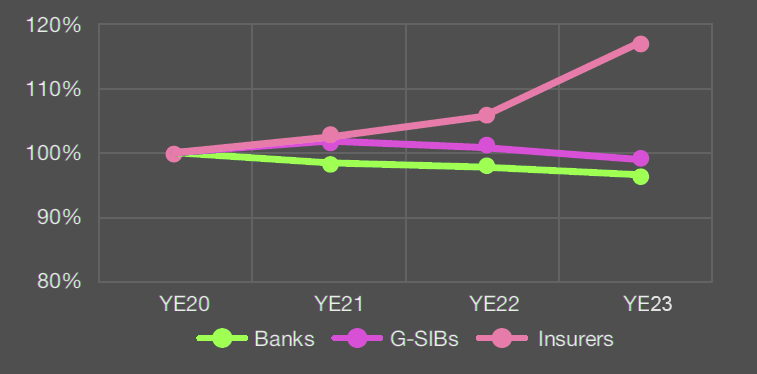

Three out of six CSA indicators increased for insurers at year-end 2023: Level 3 assets, notional amount of over-the-counter (OTC) derivatives and intra-financial system liabilities.

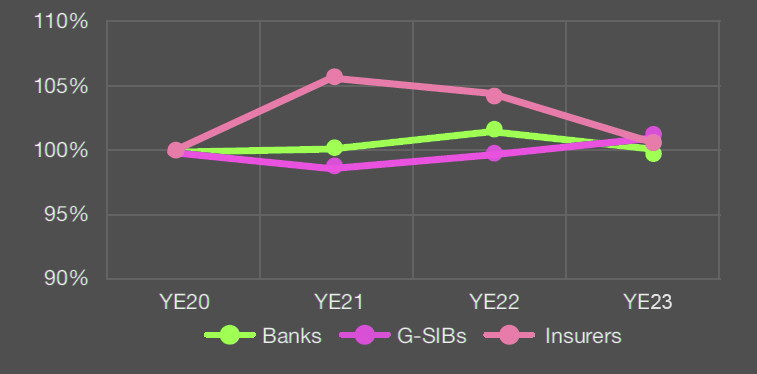

CSA: total cross-sectoral score

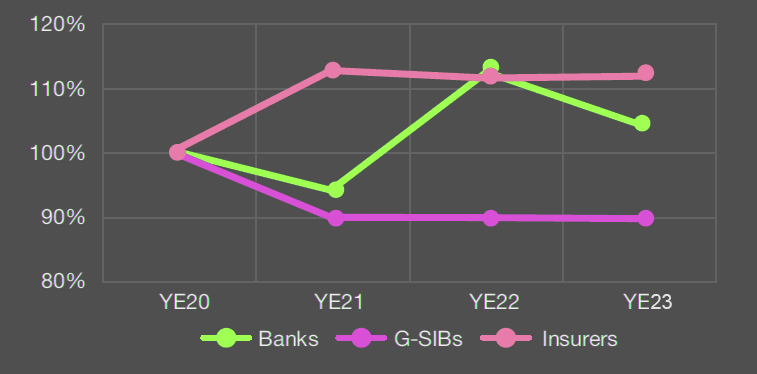

Regarding the level 3 assets, the IAIS is analysing the difference in trends for insurers and banks. This may be related to accounting differences (banks keeping a higher relative share of their assets, notably loans and mortgages, at cost than insurers, which may result in a higher level 3 assets indicator score for insurers relative to banks as assets held at cost are excluded from the level 3 assets indicator).

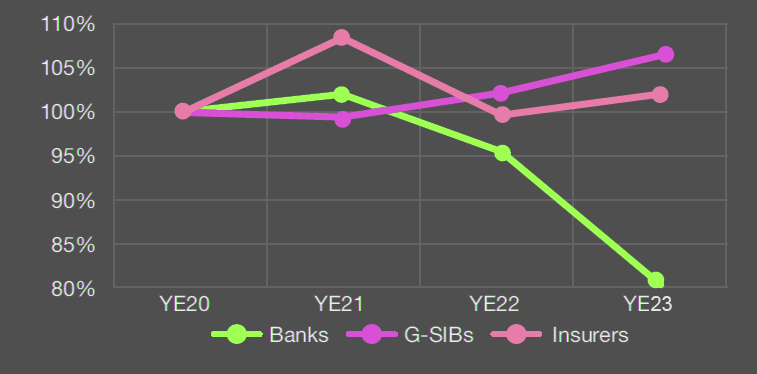

Trend in total cross-sectoral score

Notional amount of OTC derivatives indicator score

Level 3 assets indicator score

Intra-financial system liabilities indicator score

Keeping the pool of banks and insurers stable over time, the total cross-sectoral scores for banks are still significantly higher than for insurers.

Monitoring of systemic risks is a critical aspect of risk management

Monitoring of systemic risks by insurance companies is a critical aspect of risk management in the insurance sector.

This process involves several key elements:

- Understanding Systemic Risk

- Regulatory Frameworks

- Risk Assessment Tools

- Data Analysis and Reporting

- Interconnectedness with Other Sectors

- Crisis Management and Planning

Systemic risk in the insurance industry refers to the potential for a disruption at a company or within a sector to trigger a chain reaction that negatively impacts the broader financial system or economy.

This could be due to interconnectedness with other financial institutions, market dependencies, or the failure of a significant player in the industry.

Many countries have regulatory frameworks that require insurance companies to monitor and manage systemic risks.

These frameworks often include stress testing, capital adequacy requirements, and other risk management protocols designed to identify and mitigate the potential for systemic shocks.

Insurance companies use various tools to assess systemic risks. These include financial modeling, scenario analysis, and stress testing, which help in understanding the potential impact of different adverse events on their operations and the broader financial system.

Insurers collect and analyze vast amounts of data to monitor risks. They report key risk indicators to regulatory bodies, ensuring transparency and enabling oversight. This data helps in identifying trends or potential risk accumulation areas.

Insurance companies are often closely interconnected with banks, financial markets, and other economic sectors. Monitoring systemic risks involves understanding these connections and how stress in one area can impact the broader financial system.

Given the global nature of financial markets, systemic risk monitoring often requires coordination between regulators and insurance companies across different jurisdictions. This ensures a unified approach to risk management, especially for multinational insurance firms.

Insurance companies also keep an eye on emerging risks, such as those related to climate change, cyber threats, and technological advancements. Understanding how these risks evolve and their potential systemic implications is crucial.

Part of monitoring systemic risks is having robust crisis management and recovery plans.

This includes establishing protocols for responding to systemic events and mechanisms for recovery and resolution in case of major disruptions.

Overall, the monitoring of systemic risks by insurance companies is essential not only for the stability of the insurance sector but also for the broader financial system and economy. It involves a combination of regulatory compliance, risk assessment methodologies, data analysis, and global coordination to effectively identify and mitigate these risks.

………………….

AUTHORS: Shigeru Ariizumi – Chair, IAIS Executive Committee, Vice Minister for International Affairs, Financial Services Agency of Japan, Jonathan Dixon – IAIS Secretary General

Edited by Oleg Parashchak – CEO Finance Media, Editor-in-Chief Beinsure Media