Omaha-based insurtech startup Breeze has integrated with international shipping and freight forwarding firm Barrington Freight to drive improvements and save on time and costs in the cargo insurance process.

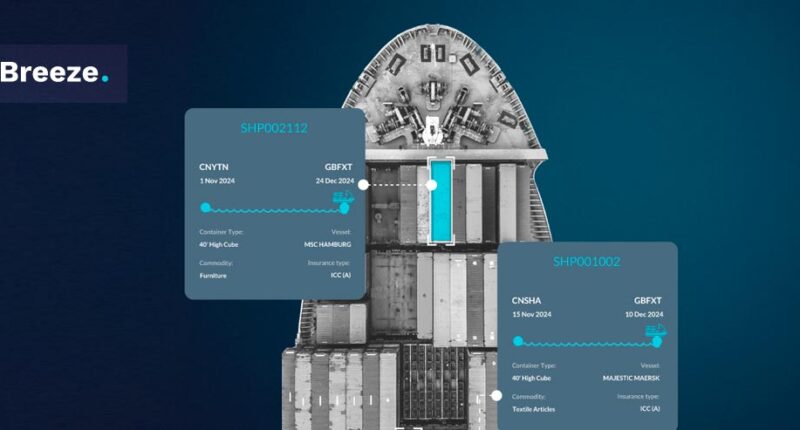

Barrington now boasts a fully integrated and automated cargo insurance process, enabling it to offer comprehensive cargo protection to every shipment it processes, without needing to add or change anything to its existing operations.

Launched in 2020 by Colin Nabity and Cody Leach, Breeze has built insurance technology that makes it easier to apply and underwrite supplemental insurance products like income protection and critical illness insurance.

The company offers consumers a completely digital way to quote, apply, and bind policies that offer protection in the event of cancer, heart attacks, strokes, and other medical conditions that can lead to a loss of income and cause financial trauma.

Utilizing Breeze’s AI-driven platform to optimize quote generation, policy binding, and claims processing, Barrington has significantly reduced the amount of time and effort needed to supply accurate cargo protection, countering the inefficiencies of traditional insurance options.

The logistics and shipping industry is no stranger to risk and unpredictability, and traditional cargo insurance methods have often proven to be costly and complex, leaving many businesses exposed to financial risks if cargo is damaged, lost, or delayed during transit

Eyal Goldberg, Chief Executive Officer, Breeze

As the logistics industry continues to evolve, making use of digital insurance solutions sets a new industry standard to give shippers and carriers access to simplified, cost-effective, and comprehensive cargo insurance that provides peace of mind and financial security.

Key benefits of the platform include seamlessly integrating into Barrington’s booking process, removing the need to source insurance separately and side-stepping the high premiums charged by third-party insurance providers, as well as streamlined claims processing, which drastically expedites the time and effort required to receive compensation.

Digitalizing cargo insurance processes demonstrates our commitment to meeting the evolving needs of clients, as well as enhances competitive edge in the modern shipping market by offering all-risk and cost-effective protection

Simon Poole, Operations Director, Barrington

“Breeze’s quick digital claim processing has proven invaluable – our previous providers kept claims pending for months, but now we are seeing claims resolved within hours”, said Simon Poole.

The integration represents the next step in Breeze’s mission to harness technology to address long-standing challenges in the insurance sector and facilitate the transformation of the multimodal freight industry into one that is safer and more sustainable.

Breeze is a mission-driven insurtech company focused on helping individuals and families prepare for the unexpected. Leveraging industry expertise and innovative technology, remote-friendly team is building a better way to buy insurance for life’s most financially vulnerable moments — like cancer, heart attacks, and bad accidents. Policies offered through Breeze can be used to help with lost paychecks, large medical bills, and more.

In 2021, Breeze sequred a $10 mn Series A round to help advance its mission to protect American families in their most financially vulnerable moments.

The financing round is led by Link Ventures, the Boston-based fund that found Breeze through its proprietary sourcing algorithms, and includes participation from Northwestern Mutual Future Ventures, Silicon Valley Bank, M25, Fiat Ventures, and Invest Nebraska.

With the funding, Breeze will accelerate the growth of its core products — disability and critical illness insurance — while also adding new products, carriers, and agents to its digital platform. The insurtech company also plans to build out its software development, customer service, distribution, and marketing teams.

Over 25% of today’s 20 year-olds will become disabled before they retire, yet the U.S. individual disability insurance market remains very small with only around $430 million written in premium in 2020.

By making disability insurance easier to buy and sell online, the insurtech can grow the stagnant market that has been limited by carriers and agents selling the product the same way for over 20 years.