In February 2024, the global mergers and acquisitions landscape was notably active with several significant transactions across various industries.

Noteworthy among these was the U.S. banking sector, where ten bank deals were announced, matching the tally from January and bringing the year-to-date deal value to $939.3 million.

M&A market is anticipated to experience an upswing, driven by factors such as improved financial markets, pent-up demand and supply of deals, and the strategic need for companies to adapt and transform their business models (see Types of M&A and Ways of Structuring Deal).

The optimistic outlook is supported by recent trends indicating an increase in deal-making activity in some sectors, with a notable rebound in areas like energy, technology, and pharmaceuticals, among others.

However, the recovery’s strength and speed may vary due to ongoing macroeconomic and geopolitical uncertainties.

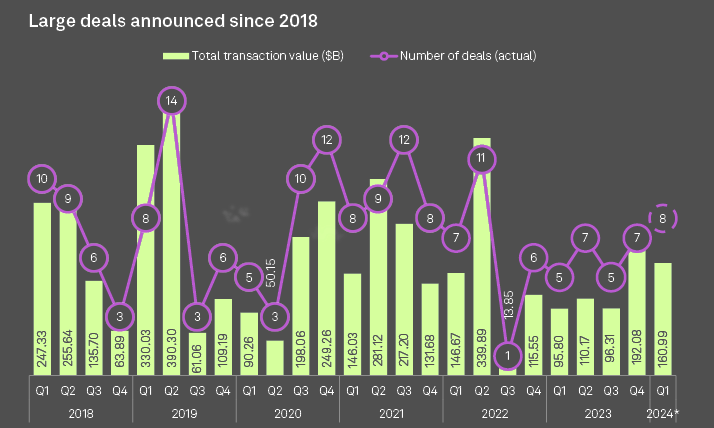

The first quarter 2024 is set to record the highest number of large M&A deal announcements in nearly two years, according to S&P Global.

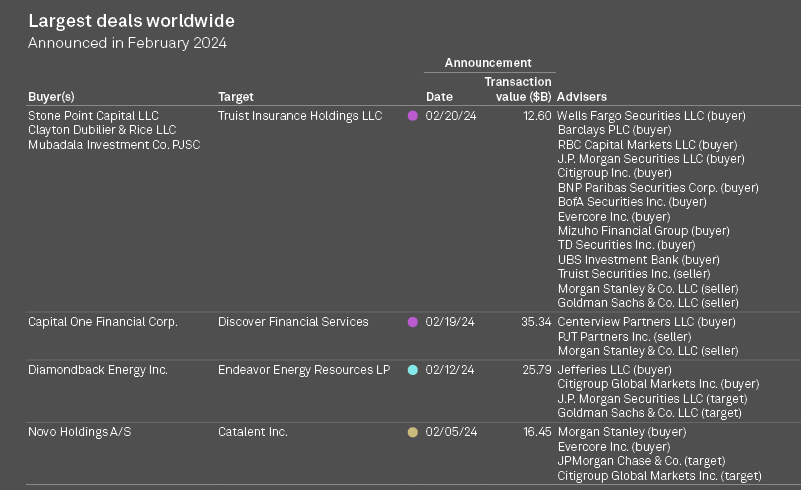

February marked the third straight month in which four global M&A deals were announced with transaction values greater than $10 billion.

With eight such deals through the first two months, the first quarter is likely to have the highest number of $10 billion-plus transactions since the second quarter of 2022, when 11 were announced.

The pickup in large deals has brought a bit of measured optimism to the investment business. “We’ve seen some encouraging signs recently, but in the big picture, there’s still some challenges there,” JPMorgan Chase CFO Jeremy Barnum said Feb. 27 during an investor conference presentation.

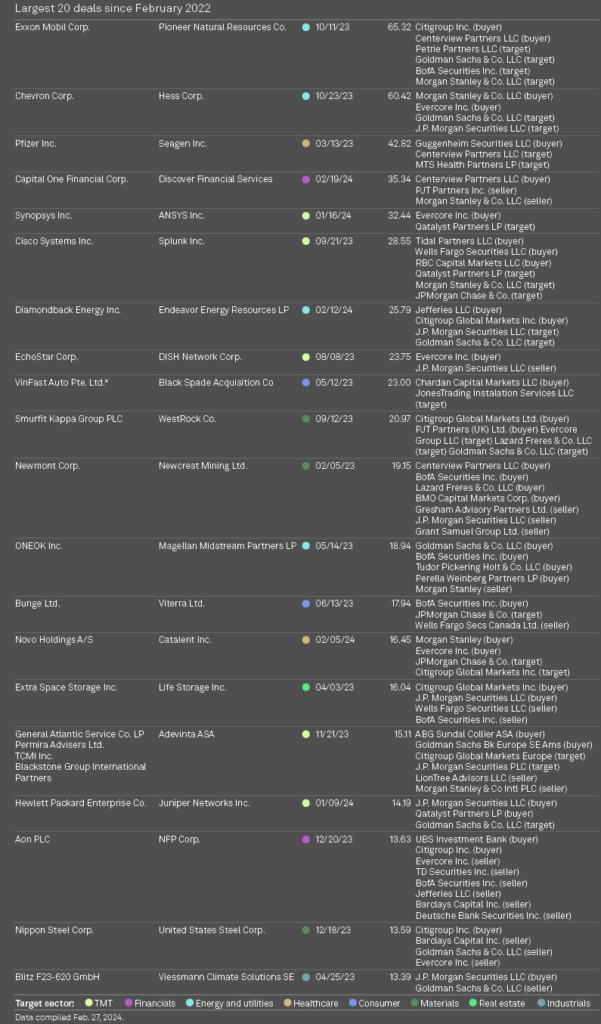

The broader M&A market saw several megadeals, indicating a resurgence in large-scale transactions.

Some of the most significant deals announced globally included acquisitions across the technology, energy, and pharmaceutical sectors, showcasing the diversity in industries seeking consolidation or expansion through M&A activities

Antitrust concerns have been raised in at least two of the $10 billion-plus deals announced in February.

Executives at pharmaceutical giant Eli Lilly said the proposed $16.45 billion sale of pharmaceutical manufacturer Catalent to Novo Holdings A/S raises competitive questions.

Novo and Eli Lilly are both clients of Catalent, which plays a key development role in the industry, Eli Lilly CFO Anat Ashkenazi said during an investor conference call in February (see Mergers & Acquisitions in the Global Insurance).

Ashkenazi said his company plans to hold Catalent accountable for its contract with Eli Lilly and is trying to gain more information on the deal between Novo and Catelent.

“Our focus today is on ensuring that continuity of supply of medicine for patients is uninterrupted,” Ashkenazi said during the investor call.

Capital One Financial Corp.’s $35.34 billion deal for Discover Financial Services quickly gained the attention of lawmakers who expressed concern. Observers said the deal will likely lead to a challenging antitrust review given the sheer size of the transaction, which ranks as the largest M&A announcement in 2024, and that it will combine two consumer-facing lenders.

“We expect that there’ll be a good level of scrutiny on the process,” Jeff Norris, senior vice president of finance at Capital One, said during an investor conference presentation. “But we feel like we’re in a pretty strong position to navigate the approval process.”

Bill Curtin, global head of the M&A practice at law firm Hogan Lovells, said the recent uptick in large deals indicates that companies are getting used to the more restrictive antitrust guidelines. Curtin said the transactions might face litigation, longer closing times and increased costs. Pursuing the transactions shows that companies view the positives of M&A as outweighing the negatives.

“Confidence with respect to how to work constructively with the regulators means M&A rises in 2024,” Curtin said on the latest edition of the Pipeline podcast. “And … $10 billion-plus, $20 billion transactions, those start to return, as you’ve seen.”

…………

by Umer Khan, Joe Mantone – S&P Global