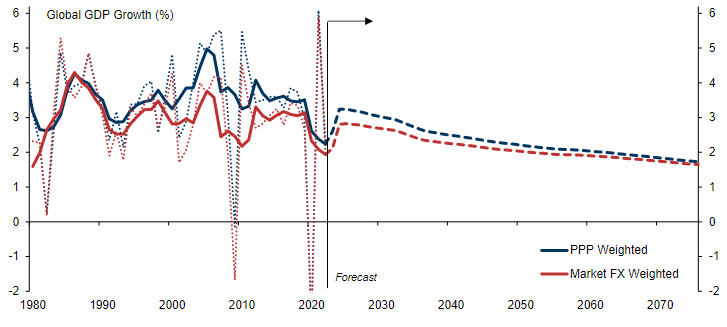

The world’s fastest years of economic growth are likely already behind it — expansion is slowing as population growth weakens, according to Goldman Sachs Research. But emerging economies, and powerhouses in Asia in particular, are forecast to keep catching up to richer countries.

It is almost twenty years since we first set out long-term growth projections for the BRICs economies and a little over ten years since we updated and expanded those projections to cover 70 emerging (EM) and developed (DM) economies (see Global Economic and Insurance Market Outlook).

Eleven years on, we are updating, expanding and extending our long-term projections, incorporating new data and new methods. Revised projections now cover 104 countries, and we have extended our projection horizon from 2050 to 2075.

In the period since our 2011 projections, the global economy has been buffeted by a number of secular challenges and economic shocks: disappointing productivity growth in the aftermath of the Global Financial Crisis (GFC), a rise in global protectionism, the Covid-19 pandemic and, more recently, the war in Ukraine.

Despite these headwinds, most of the key features of both our 2003 and 2011 projections have remained intact.

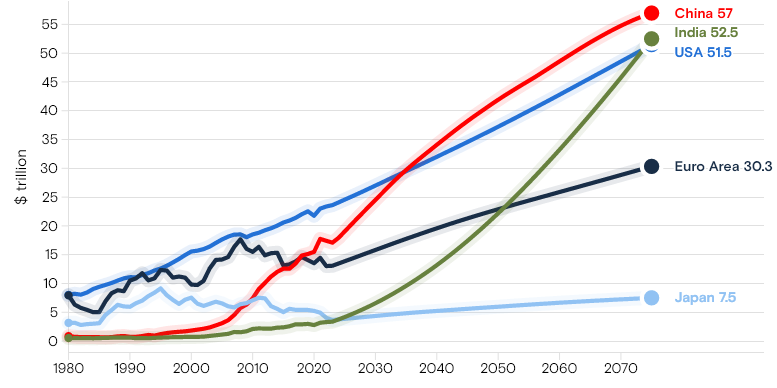

China to overtake US around 2035, while India should catch up by 2075

GDP level projections in real (2021) USD trillion

Goldman Sachs Research set out its first long-term projections for the Brazil, Russia, India, and China (BRICs) economies almost 20 years ago and expanded those estimates in 2011 to include more countries (see Global Insurance Market Forecast).

Two decades since Goldman Sachs first set out long-term growth projections for the BRICs economies, economists update and expand those projections to cover 104 countries out to 2075.

They identify 4 major themes for the global economy:

- Theme #1: Slower global potential growth, led by weaker population

growth. Our projections imply that global growth will average a little under 3% per year over the next ten years and will be on a gradually declining path, primarily reflecting slower labour force growth. Global population growth has halved over the past 50 years, from 2% per year to less than 1%, and is expected to fall to close to zero by 2075. - Theme #2: EM convergence remains intact, led by Asia’s powerhouses.

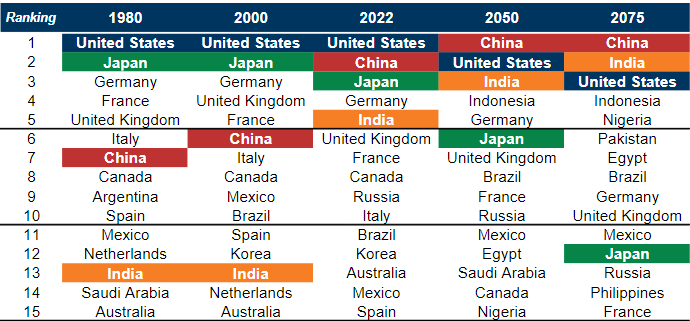

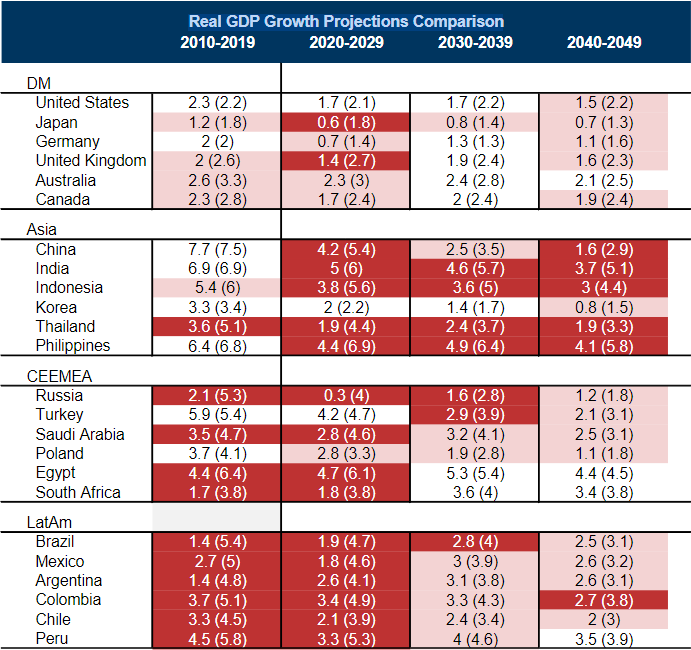

Although real GDP growth has slowed in both developed and emerging economies, in relative terms EM growth continues to outstrip DM growth. Projections imply that the world’s five largest economies in 2050 (measured in

real USD) will be China, the US, India, Indonesia, and Germany (with Indonesia displacing Brazil and Russia among the largest EMs). By 2075, with the appropriate policies and institutions, Nigeria, Pakistan and Egypt could be among the world’s largest economies. - Theme #3: A decade of US exceptionalism that is unlikely to be repeated.

The US’s relative performance has been stronger than expected over the past decade. However, history suggests it is unlikely to repeat this over the next decade. US potential growth remains significantly lower than that of large EM economies, and we expect some of the US Dollar’s exceptional strength of recent years to be unwound over the next 10 years. - Theme #4: Less global inequality, more local inequality. Twenty years of EM

convergence has resulted in a more equal distribution of global incomes. However, while income inequality between countries has fallen, income inequality within countries has risen. This poses a major challenge to the future of globalisation

Projections Imply that China, the United States, India, Indonesia, and Germany Will be the World’s Five Largest Economies in 2050

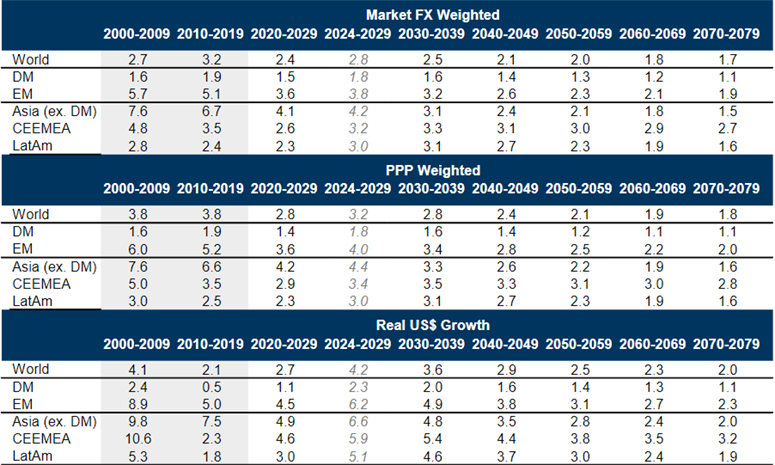

Worldwide potential growth (the rate an economy can sustain without producing too much inflation) is forecast to average 2.8% annually between 2024 and 2029 and to gradually decline thereafter (see BlackRock`s Global Macroeconomic & Invest Outlook).

That compares with an average of 3.6% in the decade before the global financial crisis and 3.2% in the 10 years before the Covid pandemic (measured on a market-weighted basis).

Global population control is a necessary condition for long-term environmental sustainability. But a population that is aging and growing more slowly will have to cope with rising healthcare and retirement costs.

The number of countries that face a serious economic challenge from a greying population is likely to steadily increase in the coming decades.

Global Potential Growth on a Gradually Declining Path

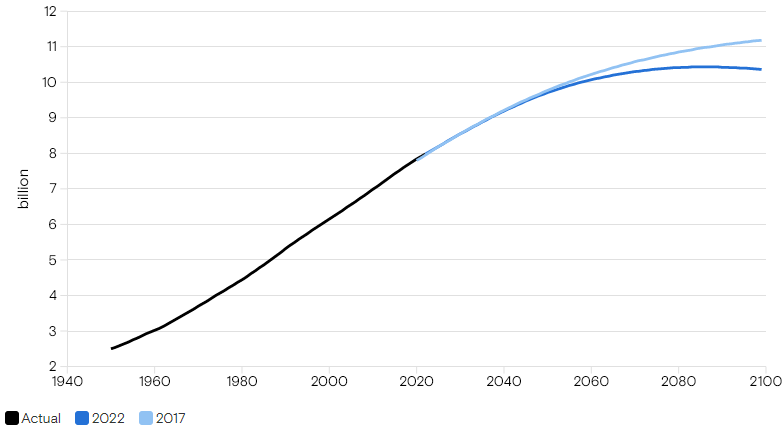

Economic expansion is ebbing as the world’s rate of population growth has halved during the past 50 years and is now at less than 1% — population growth will stall by 2075, according to UN population projections. Weakening productivity, linked to a slowdown in globalization, is also part of the reason our economists expect GDP growth to fade.

Global population growth has halved since the 1960s/70s

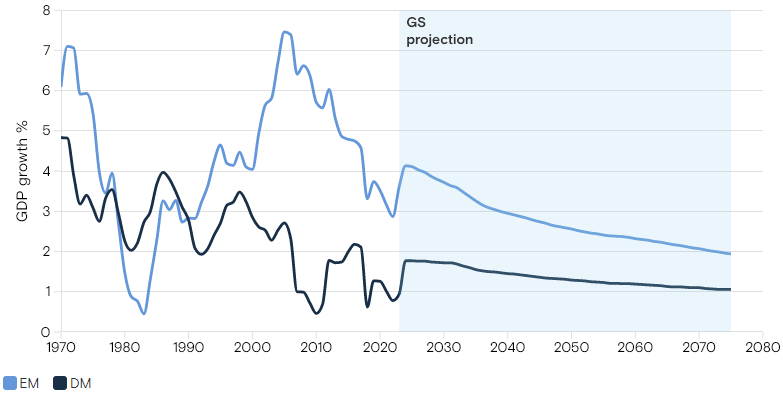

Emerging economies, led by powerhouses in Asia, are growing more quickly than developed ones, even as expansion in real (inflation adjusted) global GDP slows. Their share of the world economy will continue to rise, and their incomes are expected to slowly converge toward those of richer countries.

China is forecast to overtake the U.S. as the world’s largest economy by around 2035, while India is expected to have the world’s second largest by 2075, according to Goldman Sachs Research.

China, India, and Indonesia slightly outperformed our economists’ forecasts from 2011, while Russia, Brazil, and Latin America more significantly underperformed those projections. “We expect that the weight of global GDP will shift (even) more towards Asia over the next 30 years,” economists wrote in their latest report. In 2050, the world’s five largest economies (measured in U.S. dollars) are projected to be China, the U.S., India, Indonesia, and Germany.

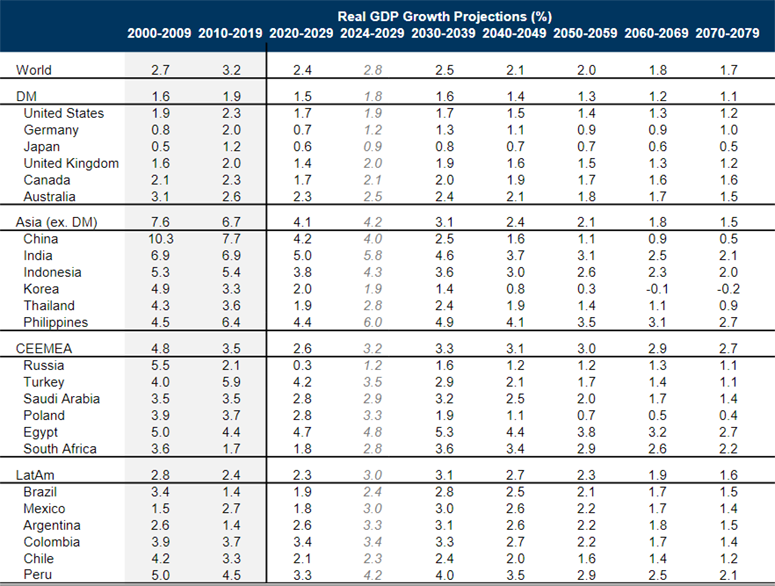

Real GDP Growth Projections Comparison

Looking out to 2075, the prospect of rapid population growth in the likes of Nigeria, Pakistan, and Egypt imply that — with the appropriate policies and institutions — these economies could become some of the largest in the world.

Economic growth is slowing in emerging and developed markets

EM vs DM growth comparison: 5-year centered average

The U.S. economy was exceptional during the past decade. It slightly outperformed our economists’ forecasts for real GDP growth, making it unique among large, developed economies. The dollar also appreciated sharply during that period, helping the relative value of the U.S. economy outstrip their expectations.

Economists say that feat is unlikely to be repeated, in part because the greenback has appreciated so much that it’s significantly above its purchasing power parity-based (PPP) fair value.

In addition, they argue that “U.S. potential growth remains significantly lower than that of large EM economies, including China and (especially) India.”

Our economists think protectionism and climate change are two of the biggest risks to their projections. Populist nationalists are in power in some countries, and supply-chain disruptions during Covid have resulted in a greater focus on resilience and onshoring.

This has resulted in a slowdown rather than a reversal of globalization, but the risks to globalization, which reduced income inequality across countries, are there. For it to continue, there will need to be more focus on sharing the benefits of globalization and rising incomes within each nation.

Achieving sustainable growth requires economic sacrifices and a globally coordinated response, both of which will be politically difficult to achieve.

When it comes to climate change, many countries have been able to decouple carbon emissions and economic growth, which indicates it should be achievable for the global economy as a whole. But that doesn’t mean it will be easy.

A Gradual Slowdown in Global Economic Growth, With EM Growth Continuing to Outstrip DM

Real GDP Growth Projections for Major Economies by Decade

The 10 years following the creation of the BRICs acronym in 2001 represented a golden era for emerging market economic and financial market outperformance. Between the early 2000s and the 2007/08 Global Financial Crisis (GFC), growth was unusually strong in most economies and especially so in EMs, fuelled by exceptionally rapid globalisation.

And, while the Global Financial Crisis drove developed economies into a deep and lengthy recession, the majority of EMs weathered that storm relatively well. For most economies and in most respects, our first set of BRICs projections underestimated the speed of EM convergence over the subsequent 10 years.

……………………………

by Oleg Parashchak – CEO Finance Media, Yana Keller – Beinsure Media