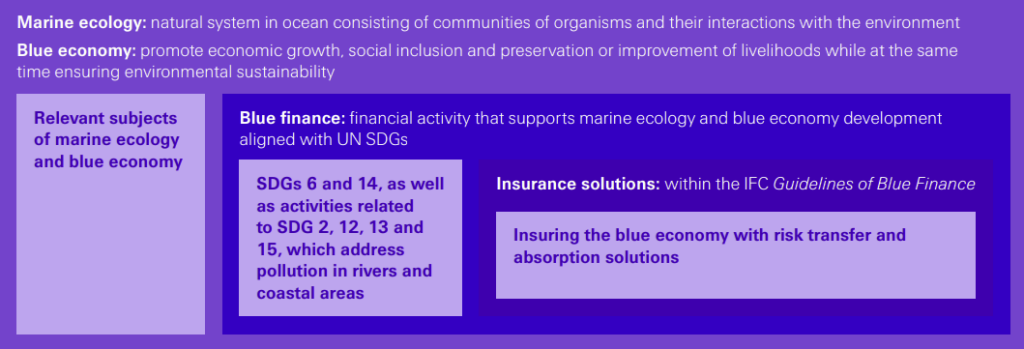

Waterways and oceans are critical for life on earth and the global economy, and there is growing awareness of the need to use these resources more sustainably. The UN defines the sustainable use of ocean and freshwater resources to foster economic growth and livelihoods as the “blue economy”.

According to Swiss Re Institute Report, the International Finance Corporation (IFC) has now defined a related term, “blue finance”, as the financial activities that support the sustainable development of ocean-friendly projects and protection of critical clean water resources, based on the UN Sustainable Development Goals (SDGs).

The blue economy globally is worth an estimated USD 2.5 trillion annually, according to UNCTAD, equivalent in size to the world’s seventh-largest economy, and is expected to reach over USD 3 trillion by 2030.

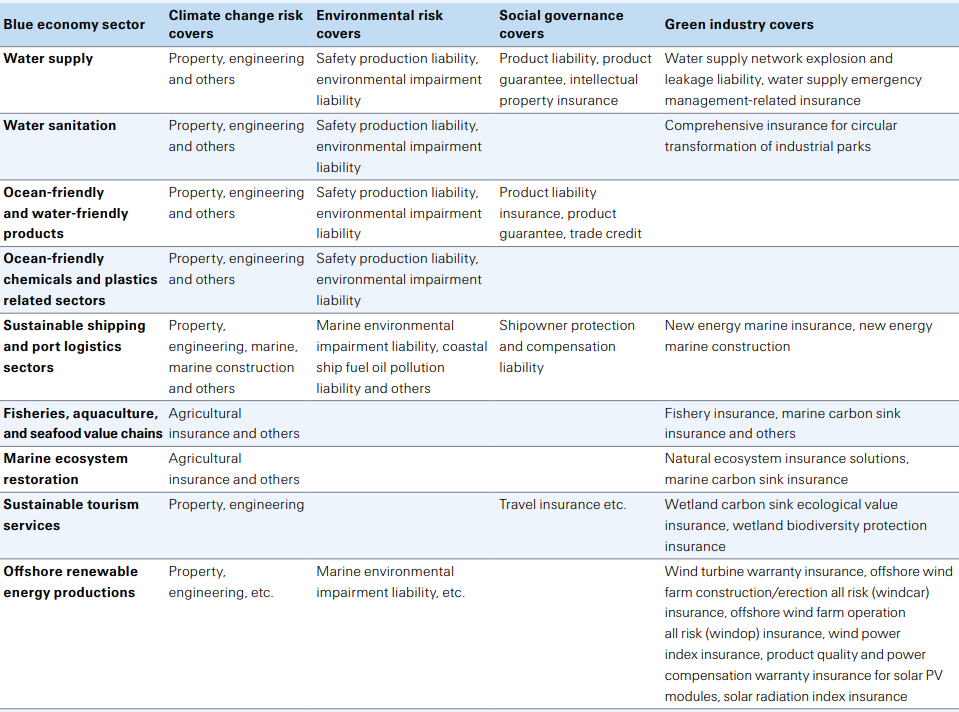

It includes sectors ranging from sustainable and efficient water supply and sanitation to ocean-friendly chemicals and plastics, fisheries, offshore renewable energy production, sustainable tourism and marine ecosystem restoration.

Blue finance is intended to fund the blue economy while reducing the carbon emissions and pollution such activities may produce, improving the efficiency of energy and natural resource use, and protecting biodiversity. We believe insurance has a key role to play in transferring and absorbing the risks these sectors and activities face.

Insurance in this context aims to protect against insurable perils in marine and freshwater ecosystems, and enable the development of the blue economy.

Using the IFC’s Blue Finance Guidelines, and China’s green insurance regulatory framework, we identify insurable physical and transformation risks associated with the development of ocean- and freshwater-friendly projects and the protection of critical clean water resources.

These risks are primarily discussed in this report based on a Chinese context, though such exposures can occur globally.

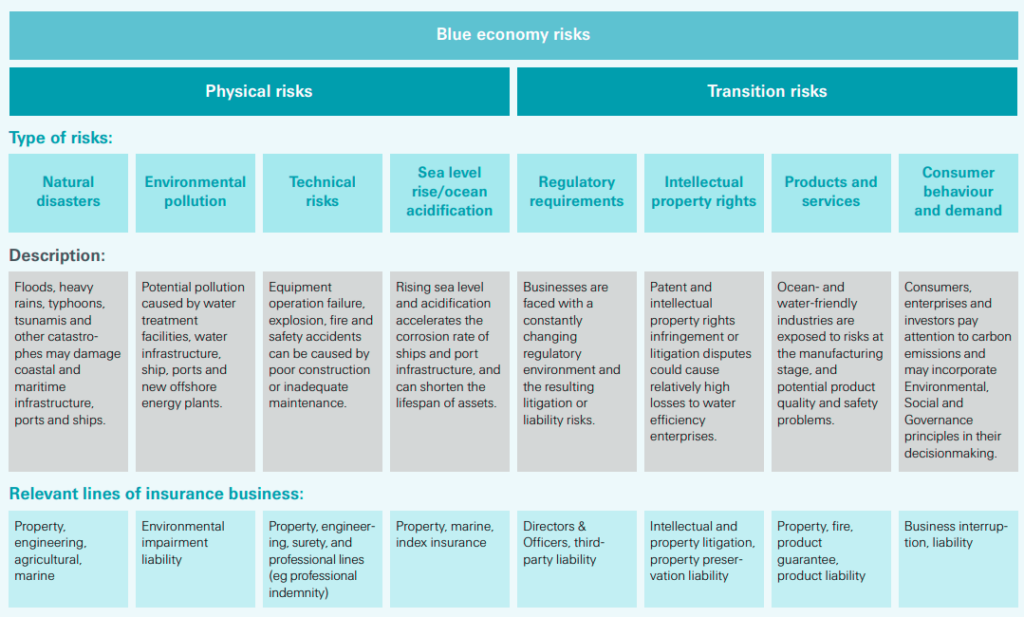

We see eight major risk factors that fall under these two categories. Under physical risks: natural disasters, natural ecology and environmental pollution, technological risks, sea level rise and ocean acidification risks (see 4 Major Themes for the Global World Economy). Under transition risks: regulatory requirements, intellectual property, changing format of products and services, and evolving customer behaviours and demand.

If the blue economy were insured to the same degree as property, it could equate to premium potential of about USD 100 billion globally per annum today and USD 120 billion by 2030.

Advanced risk transfer solutions to support the blue economy are still evolving. Insurance to absorb and transfer these risks today starts with covers such as traditional property, engineering and environmental impairment liability, for instance to insure sustainable plastic production facilities or offshore renewable energy.

These extend to production liability, agricultural, marine and business interruption covers. However, blue economic growth is expected to establish new risk pools, such as marine carbon sink index insurance.

The development and application of, for example, new energy and carbon capture technologies and associated expanding scenarios, along with the accumulation of risk data, is likely to extend the boundaries of insurability.

As demand for risk protection solutions grows, we anticipate innovation by insurers in three areas: insurance product design, cooperation in business models, and risk management services.

Product innovation could include protecting marine ecologies from physical risks and in value terms, by pricing the costs of ecology restoration after an extreme weather or other natural disaster event, for example. Insurance can also offer solutions for emerging fields such as sustainable tourism and transformation of the shipping industry.

Insurance provides risk transfer solutions for the blue economy

Insurers may consider innovation in their business models to enable cross-sector collaboration, with a focus on “insurance + services”, and “insurance + credit” (financial loans and support).

We see opportunities for the insurance industry to consider working with public sector and corporate stakeholders to better safeguard and sustainably develop the blue economy. With the synergies from integrating available financial resources and services, insurers may be well positioned to comprehensively enable the development of the blue economy.

Insurance offerings can help improve protection for the physical risks and transformation risks of the blue economy

The blue economy and blue finance

The UN defines the blue economy as the sustainable use of ocean and freshwater resources to foster growth and livelihoods. The IFC has subsequently conceptualised blue finance as putting the sustainable development of oceans and freshwater resources at the heart of associated financial activities.

Financing the sustainable use of ocean and freshwater resources

The aim is to use finance to promote economic behaviours that can ensure the sustainable development of water ecosystems, including actions to reduce carbon emissions and pollution, improve the efficiency of energy and natural resource utilisation and to protect biodiversity. The IFC aligns the blue finance framework with the UN’s Sustainable Development Goals.

The UN’s Sustainable Development Goals

Specifically it references SDG 6, which aims to achieve availability and sustainable management of water and sanitation for all, and SDG 14, which targets to conserve and sustainably use the oceans, seas and marine resources for sustainable development. SDGs 2, 12, 13 and 15 address pollution in rivers and coastal areas.

The Blue Finance Guidance framework includes activities related to the UN SDGs that address pollution in rivers and coastal areas:

- Sustainable and efficient water supply

- Sustainable and efficient water sanitation

- Ocean-friendly and water-friendly products

- Ocean-friendly chemicals and plastic related sectors

- Sustainable shipping and port logistics sectors

- Fisheries, aquaculture and seafood value chain

- Marine ecosystem restoration

- Sustainable tourism services

- Offshore renewable energy production.

Insuring the blue economy

Insurance in this context aims to protect against insurable risk perils in marine and freshwater ecosystems, and enable the development of the blue economy.

Basic features of blue economy

The regulator defines green insurance as the general term for insurance that can provide risk protection and financial support for environmental resource protection and social governance, green industry development, and green living consumption.

Risks and roles for insurance in the blue economy

This research identifies the major commercial risks associated with blue economic activity for stakeholders both in China and globally. It considers eight major risk areas in the blue economy, in two key groupings: physical risks, including natural disasters, environmental pollution, technical risks, sea level rise/ocean acidification risks; and transition risks, including regulatory requirements, intellectual property rights, products and services and demand and consumer behaviours.

Blue economy physical and transition risks, and associated risk factors

Types of insurance for Blue economy

1. New drinking water treatment, storage and sustainable supply infrastructure

Types of insurance: property and engineering insurance can help protect the waterinfrastructure against catastrophe and climate change risks. At the same time, Chinese insurers are developing water supply network leakage liability and water supply emergency management related insurance.

They are also promoting services such as emergency treatment and loss adjustment, and the establishment of a risk-sharing scheme to manage water-supply emergencies.

2. Sustainable desalination plants

Types of insurance: established insurance lines for these risks include environmentalimpairment liability insurance, which can offer cover against potential contamination of desalination plants; safety production liability insurance, which can protect plant safety and longevity of plant operations and business; and property and engineering covers, which can compensate for losses resulting from natural catastrophes and climate change.

The insurance industry may develop innovative products based on desalination energy consumption and product quality control, or guarantee the manufacturing of engineering equipment for desalination.

3. Water efficiency technologies/equipment and water management activities

Types of insurance: intellectual property insurance can improve the efficiency oftechnology companies by better protecting them against risks such as lost revenue from IP infringements, the legal cost of taking action against IP infringements or defending allegations, and the damages payable if the insured loses an infringement action, etc.

With the establishment and protection of intellectual property rights, water-saving technology companies can gain better access to capital and expand scale of production. Water efficiency technology companies can also benefit from using product liability insurance or product guarantee insurance with independent charter coverage, so enhancing consumers’ trust in new products.

4. Water sanitation

Types of insurance: property and engineering, environmental impairment liability andsafety production liability insurance can provide risk protection for wastewater treatment plants against risks of natural catastrophe events, pollution, legal defence and workers’ injuries. There can also be tailored risk transfer solutions for the process of recycling of wastewater.

5. Ocean- and water-friendly products

Types of insurance: property, engineering, environmental impairment liability andsafety production liability insurance covers can protect manufacturers of ocean- and water-friendly products against the risks inherent in production.

Trade credit insurance can protect operators against manufacturers’ default risks. Product liability insurance offers protection against the personal injury or property losses of third parties caused by product defects, while product guarantee insurance can address quality risks incurred in the sale of products.

6. Ocean-friendly chemicals and plastic-related sectors

Types of insurance: environmental impairment liability insurance can mitigate pollution and other risks, and insureds can benefit from risk management services offered by insurers. China’s regulator encourages property insurers to enhance risk mitigation services in environmental impairment, safety production and food safety liability insurance etc.

7. Sustainable shipping and port logistics sectors

Type of insurance: for ships with sustainable technologies and systems, protection and indemnity P&I insurance covers the liability for personal injury, property damage and environmental pollution caused by third parties during ship passage.

Meanwhile, environmental impairment liability or fuel oil pollution liability insurance can cover economic losses arising from ocean pollution due to leakage of fuel oil, oil products, chemicals and other harmful substances resulting from unexpected events (ie, not the liability for the emissions that come with the standard operations of ships).

And port operators can purchase property or engineering insurance products to protect against losses arising from natural disasters and business interruption. All such covers exist globally today.

Regarding decarbonisation, new-energy ships using clean energy such as liquefied natural gas (LNG), methanol, hydrogen and battery power can today be insured with new energy hull insurance and new energy builders’ risk insurance to cope with their different risk characteristics to traditional fuel ships. At present, other forms of insurance for new-energy ships are still in the developmental stages.

8. Fisheries, aquaculture and the seafood value chain

Types of insurance: traditional agricultural insurance products can cover the losses fisheries incur as a result of natural disasters Insurers can also develop certain green insurance products that provide risk management services for the sustainable fishery

operations.

A financial environment conducive to sustainable fisheries can be created by incorporating environmental performance requirements for production in terms and conditions, and making sustainable practices an essential condition for coverage. Some fishery products, such as shellfish and algae, have a degree of carbon sink value and can be protected by carbon sink insurance products, a new form of insurance.

9. Marine ecosystem restoration

Types of insurance: that can cover risk of natural disasters foroperators of marine and coastal ecosystems, and also help to protect, sustain and restore natural ecosystems, are currently limited. Where available, insurance can help to mitigate challenges such as climate change effects, food and water security, and disaster risk reduction, while delivering benefits to humans and biodiversity. Liability insurance can cover third-party losses.

As a new application of insurance, insurance products that support nature-based solutions can directly or indirectly reduce and manage risks that the natural ecosystems face. The insured objective is the value of related ecosystem services and their economic income.

Such products can include disaster clean-up, post-disaster reconstruction and restoration, and property insurance. In addition, components of marine ecosystems such as seagrass beds and mangroves have a degree of carbon sink value, which can be insured through carbon-sink insurance.

10. Sustainable tourism services

Types of insurance: property and engineering covers can protect resorts and hotels inBlue Sustainable Tourism Zones against risks such as natural disasters, fire and business interruption. Insurance like gross ecosystem product related insurance and wetland biodiversity insurance policies can protect the value of ecological values of marine nature reserves and special reserves.

Travel insurance products can cover risks of accident, emergency and other risk for blue sustainable travel service agencies. China’s government is encouraging insurers to innovate and develop exclusive products for tourism, while encouraging stakeholders such as travel agencies and tourist venues to enhance insurance protection.

11. Offshore renewable energy facilities

Types of insurance: the safety and stability of a facility, as well as potential risks duringoperation and maintenance phase are core risks faced by offshore renewable energy facilities. Insurance covers can provide financial compensation for damage resulting from equipment failure, natural disasters or human causes.

Property insurance can protect the direct loss of renewable energy facilities, and engineering insurance can protect the construction of facilities or project delay, etc. Marine environmental impairment liability insurance can address the potential environmental risks.

Offshore wind power projects can be insured with wind power equipment product quality guarantee insurance, offshore wind power insurance for construction and installation period, offshore wind power insurance for operation period, and wind power index insurance. For offshore solar power stations, long-term quality and power guarantee insurance for solar photovoltaic modules and solar exposure index insurance.

Innovative insurance solutions

The evolution of the blue economy and its related technologies are expected to give rise to new risk pools. To better support sustainable development, insurers can consider innovation in product design, cooperation models and risk management services to meet expected demand for associated risk protection.

Insurance product innovation around blue economic activities involves many fields. Here we present just a few examples as a means to demonstrate the possibilities.

1. Marine ecology: protection, restoration and value development

Marine ecology is the foundation of the marine economy, and its protection and restoration is imperative. The insurance industry is exploring innovation in nature-based solution projects and marine ecological products.

2. Coastal zone protection and restoration

Coastal zone restoration is one key area of sustainable development for coastal cities. Nature-based solutions have gradually been recognised and accepted in recent years, where the self-healing capacity of marine ecosystems can be supported and optimised by ecosystem restoration measures.

For ecological measures such as planting mangroves and placing algae reefs, insurers can leverage their expertise to develop customised parametric insurance solutions that provide projects with funds for post-natural disaster restoration in a timely manner. Coastal zone restoration could also make use of engineering-type measures, such as ecological transformation of seawalls. Insurers need to consider the risk factors of ecological measures in addition to traditional engineering risks.

3. Gross ecosystem product (GEP) insurance

According to the International Union for Conservation of Nature (IUCN), GEP is the total value of final ecosystem goods and services supplied to human well-being in given region annually. Understanding the insurance market opportunities of natural ecosystems such as wetlands and tropical forests is a still-developing field. In this area, innovative marine insurance solutions based on the concept of the GEP could be designed to reduce uncertainty in the realisation of the ecological value of marine ecological products, and provide financial support to improve the resilience of natural resources against various risks.

4. Blue carbon insurance

Ocean carbon sink refers to the processes, activities and mechanisms by which mangroves, salt marshes, seagrass beds, phytoplankton, macroalgae, shellfish and others absorb and store atmospheric carbon dioxide from the air or seawater.

As innovative carbon finance tools, insurance products can help to secure the value of ecological resources, encourage operators to participate in the protection of ecological resources, and promote the benign relationship between carbon sink value and carbon trading value.

The insurance mechanism provides risk protection for carbon sink losses and market fluctuations for business entities participating in carbon sink transactions. It helps stabilise the value of carbon sinks and transaction income, and improves the carbon sequestration capacity of natural resources.

5. Water-saving technology: well-facilitated farmland inherent defect insurance

As the construction of well-facilitated farmland in China progresses each year, a large number of transport, drainage and irrigation facilities have been built and upgraded.

Compared with traditional ground irrigation, water-saving irrigation improves the utilisation rate of water and reduces waste. The use of rain collection facilities like ponds and dams built in accordance with local conditions, has further improved the utilisation rate of agricultural water. Well-facilitated farmland inherent defect insurance (IDI) can provide multi-year project guarantee insurance for assets such as water source projects and irrigation systems involved in the construction of well-facilitated farmland. Swiss Re has established a complete risk management system for this.

6. Tourism: business stability and sustainable development

For coastal regions, tourism is often a key pillar of the local economy. Sustainable tourism supports livelihoods and business opportunities in local areas. Insurers can provide tailor-made parametric and business interruption risk protection covers. Parametric insurance solutions based on typhoon wind speed and path, rainfall, etc, can provide post-disaster restoration expenses for the local tourism industry. At the same time, business interruption insurance can provide compensation for income losses resulting from extreme weather or other natural catastrophe events.

7. Shipping industry: green transformation

In supporting sustainable shipping activities and the application of new energy in the shipping industry, insurance solutions that can help with reducing carbon emissions are attracting increasing attention.

8. Digital transformation of port logistics industry

The world’s major ports are digitally transforming and optimising the efficiency of onshore and offshore logistics to support decarbonisation goals. Congestion in logistics may result in carbon emissions exceeding targets. Given that logistics data can be monitored and measured, parameters based on the flow of goods through ports can be developed into innovative indexed insurance products. The design of such indexed products can be based on historical cargo, ship and truck turnover data, and estimated port carbon emission data thresholds for the next few years.

9. Insurance + risk management services

The insurance industry has continued to expand the breadth of its services to meet increasing demand for blue-economy related risk protection services. The industry is evolving from a single “post-event payer” to also being an “ex ante event risk manager” that can provide early warning signals of risk occurrence, use more advanced technology and improve the efficiency of risk controls. In recent years, risk management has become an important component in specific lines of business, such as safe production liability insurance and technical inspection services IDI.

Blue economy activities are based on the ethos of environmental friendliness and sustainability, which give rise to new risks. These require risk management services. Take clean water supply projects as an example.

With the rapid development of new technologies such as Big Data and the Internet of Things (IoT), the insurance industry is taking risk management services to a new level. Take the aquaculture industry as an example. Aquaculture coverage is one of the most challenging types of insurance, given the complexity of value and loss assessment.

Insurers have sought to combine “parametric insurance + tech-enabled risk controls” for more scientific and objective loss assessment. For instance, with the IoT, insurers can set up a remote water quality monitoring system of water temperatures, pH indicators and dissolved oxygen etc in fish farms.

10. Credit + insurance

The blue economy is still in a developmental stage and financial industry support is core to support its growth. Insurers have insights and expertise in risk identification and pricing. With insurance covers, corporates can have more stable financial flows, which can complement and increase the scale of loans that banks offer for blue projects. For example, insurers could collaborate with banks to offer risk covers and financial loans as a joint solution.

The data accumulated by the industry in the fields of natural disasters, environment and safety in production can help banks do overall risk screening and rating of their portfolio and identify high-risk enterprises. The use of such insurance products may also boost confidence in enterprises, potentially leading to increased credit from banks.

…………………..

AUTHORS: Xin Dai – Chief Economist China, Swiss Re Institute, Steven Yang – Senior Risk Manager P&C China, Group Risk Management, Lindsay Jiao – VP, Public Sector Solutions – Senior Client Manager Swiss Re Institute

The authors thank Jay Li, Wei Chen, Han Chen, Jason Wu, Shirley Li and Xing Wang