Mystery shopping in insurance is a technique that involves the use of trained “mystery shoppers” acting as potential customers. It allows the experience of customers in practice to be assessed, according to EIOPA. It would typically involve physical visits to distributors’ premises but also can be done via digital channels, phone calls or similar methods (see UK Home Insurance Market Research).

One of the key challenges continues to be conversions: how to maximise the number of enquiries or quote requests that result in new policy sales, new customers, and revenue.

What is mystery shopping in Insurance?

Mystery Shopping can be a powerful tool to help insurance providers and brokers to maximise conversions, so they can get ahead, and stay ahead, of the competition. Customerwise is fast becoming a provider of choice in this industry, for good reason.

“Mystery shoppers” perform tasks that any potential customer might carry out (i.e. ask for information about product features, request for advice, etc.).

While doing so, “mystery shoppers” gather detailed information on how providers sell their products or provide services to consumers in order to report ‘live’ observations on consumers’ outcomes in a structured, detailed and systematic manner (see how Effective Use of Customer Data Can Help Insurers Reduce Explosure Risks).

How could mystery shopping enhance existing conduct of business supervision?

Collecting information from point-of-sale interactions, whether these take place face-to-face or digitally, informs supervisors on consumers’ experience and reinforces their understanding of how fair and transparent selling processes are from a consumer protection standpoint.

Mystery shopping visits allow a close monitoring of providers’ practices and alert supervisors on whether such practices are detrimental to consumers.

It allows to take an outcome-focused approach to conduct of business supervision (see How Digital Trust, AI & IoT Technology Can Help Insurance Business?).

The main objectives of mystery shopping are:

What consumer protection issues can be explored via mystery shopping?

Mystery shopping gives particular insights on consumer risks arising in the product delivery phase as part of the interaction between consumers and distributors at the point of sale (see 10 Key Technology Strategies for Insurance Companies).

Besides the benefits emerging from the use of mystery shopping in relation to distribution, this supervisory tool could be also valuable when assessing other areas of risk associated to the way that manufacturers’ structure, drive and manage their business and how products are targeted to consumers.

Do mystery shopping campaigns fit into the existing supervisory tools?

Mystery shopping can be used in conjunction with other supervisory tools in order to exploit synergies amongst them. Indeed, mystery shopping provides information that supports either the detection of conduct issues or allows for deep investigations of those which are already of concerns.

Other supervisory tools could enhance the definition of area(s) of focus of potential mystery shopping exercises (i.e. using intelligence or data emerging from regular market monitoring), while mystery shopping could fill gaps of other tools or help in the assessment of findings arising from other tools.

How does a mystery insurance shopping campaign work?

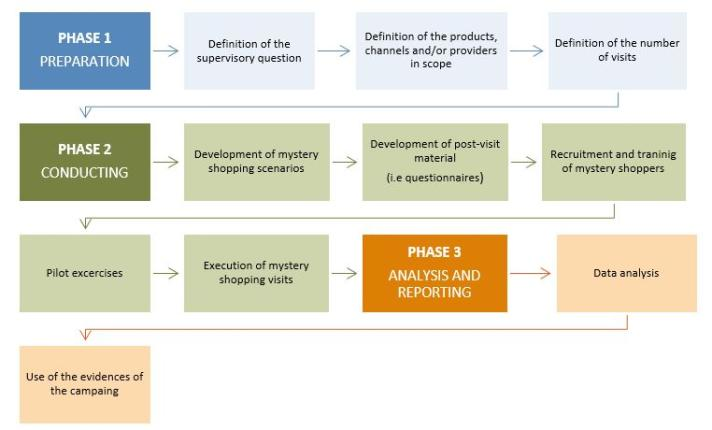

Mystery shopping campaigns are composed of diverse activities starting from the definition of the topic to investigate and concluding with the analysis of the data and respective reporting of the collected results.

The Board of Supervisors of the European Insurance and Occupational Pensions Authority agreed that EIOPA will coordinate the first joint mystery shopping exercise on sales of insurance conducted in 8 EU States.

Mystery shopping was used to gather first-hand evidence of what someone looking for investment advice from a bank or building society might experience. The use of mystery shopping as a supervisory tool is an example of the more intrusive approach that will be used by the Financial Conduct Authority. In total 231 mystery shops took place.

The results show that, while approximately three-quarters of customers received good advice, there were concerns with the quality of advice:

- In 11% of mystery shops, the evidence suggests that the adviser gave the customer unsuitable advice.

- In 15% of mystery shops, the evidence suggests that the adviser did not gather enough information to make sure their advice was suitable – so it was not possible to assess whether the customer received good or poor advice.

The main reasons for poor advice were that advisers’ recommendations were not suitable for:

- the level of risk customers were willing and able to take (15% of mystery shops);

- customers’ financial circumstances and needs, for example, advisers failing to recommend the repayment of unsecured debts (such as loans), where this would have been the right option for the customer (13% of mystery shops); and

- the length of time customers wanted to hold the investment (6% of mystery shops).

In response to this report, the firms involved were cooperative and agreed to take immediate action. This includes retraining advisers, making substantial changes to their advice processes and controls for new business, and undertaking past business reviews to identify historic poor advice and put this right for customers. Firms have also been required to employ an independent third party to either carry out or oversee this work. One firm has been referred to enforcement.

Output for Insurance Mystery Shopping Clients

For every enquiry that’s made by our Mystery Shoppers, clients receive a full written and scored report, containing plenty of detail, and this is supplemented by a recording of the call itself.

But as well as providing great reports on individual interactions, what’s also important is helping clients to understand and explore their performance data, as clearly and as efficiently as possible – so they can act on it…

………………

Edited by