Insurtech Root has rebuffed a takeover bid — and thrown in a lawsuit for good measure — from Embedded Insurance even though the offer was one of the highest price premiums in the North American property and casualty space over the past decade, according to S&P Global Market Intelligence.

The offer is reported to be $19.34 per share, according to The Wall Street Journal, a valuation of about $180 million based on the amount of outstanding shares of its Class A common stock.

However, this is a fraction of the insurance technology company’s peak market capitalization of $6.69 billion shortly after its initial public offering in 2020.

According to a court filing obtained by S&P Global Market Intelligence, Root responded to a June purchase proposal from Embedded by saying the offer was “not in the best interest of Root and its stockholders.”

Root is also bringing a civil action against Embedded in the Delaware Chancery Court alleging violation of a nondisclosure agreement (NDA) between the two parties. The insurtech accused Embedded of violating an NDA by providing information about the sale proposal to The Wall Street Journal, according to the complaint.

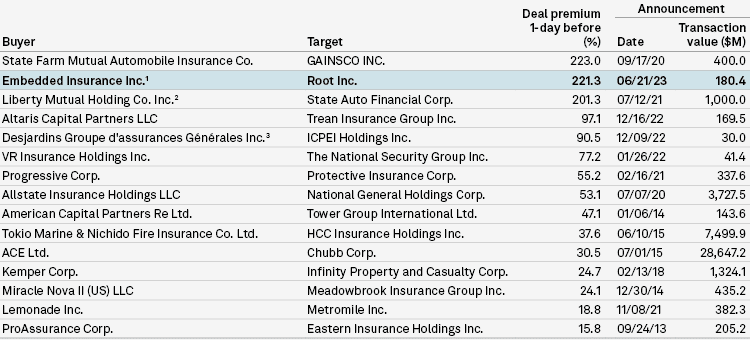

The one-day price premium for the reported bid was 221.3% over Root’s closing price of $6.02 on June 20.

In a short public statement June 29, Root said it was not in receipt of any proposal that was “either actionable or in the best interests” of its shareholders. Root shares dived sharply in after market trading the same day.

Embedded’s bid is one of the highest premiums in the US P&C sector in recent years.

Only State Farm Mutual Automobile Insurance Co.’s purchase of GAINSCO Inc. in 2020 had a one-day price premium greater than Embedded’s offer for Root. State Farm paid a 223% premium for the non-standard private auto insurer.

Liberty Mutual Holding Co. Inc.’s acquisition of the publicly traded subsidiary of the State Auto Group also reported a one-day price premium greater than 200%. The deal premium included the purchase of State Automobile Mutual Insurance Co., which is not reflected in the company’s public share price.

Under the terms of the agreement, State Auto Mutual members were transferred to Liberty Mutual, while the Boston-based insurer acquired all the publicly held shares of common stock for State Auto Financial Corp. for $52 per share in an all-cash deal for roughly $1 billion. State Auto Financial shares closed at $17.26 on the last trading day prior to the announcement.

Lemonade’s purchase of Metromile was roughly a 19% premium of the insurer’s closing price on Nov. 5, 2021.

For the third consecutive quarter, Root’s reported direct incurred loss has been lower than that of the combined US private auto industry, according to a review of regulatory statements. The insurer’s direct incurred loss ratio was also better than two out of the three largest US private auto underwriters during the same period.

The Root’s direct incurred loss ratio was 71.8% during the first three months of 2023, compared to 76.2% for the entire US private auto industry.

The insurer’s loss ratio in the first quarter was roughly an 11-percentage-point improvement from the prior-year period.

The better underwriting performance has been aided by stricter underwriting measures and recent rate increases, according to comments made by CFO Megan Binkley during Root’s earnings call. Binkley further noted that loss ratio improvements remain a top priority and the insurer will seek to increase rates as needed.

The company recently received approval for a substantial rate increase in California after the state’s regulator granted the 62.4% rate increase it sought in February 2023. The insurer recorded direct premiums written of $7.6 million in the Golden State in 2022.