Louisiana’s insurers paid out more than $23 billion after the 2020 and 2021 hurricane seasons, driving a number of them into insolvency, according to an Issues Brief Trends and Insights: Louisiana’s Insurance Crisis released by the Insurance Information Institute.

12 insurers that write homeowners coverage in Louisiana were declared insolvent between July 2021 and February 2023, large part due to the severity of the insured loss payouts in the wake of 2020’s Hurricane Laura and 2021’s Hurricane Ida.

The Laura losses across all insurance lines stood at $9.1 billion in Louisiana a year after it made landfall whereas Ida prompted Louisiana’s insurers either to pay, or to set aside, another $13.9 billion in the aftermath of that storm.

Hurricanes Delta and Zeta, both of which made landfall in Louisiana in October 2020, cumulatively generated another $1.5 billion in insured auto, home, and business insurance claim payouts, according to the Louisiana Department of Insurance (LDI).

While Louisiana’s troubles owe more than Florida’s to hurricane-related losses, the state is no stranger to legal system abuse (see U.S. Home Insurers Have of the Highest Level of Catastrophe Exposure to Hurricane Ian).

As Florida strives to address the issues that led to its current property/casualty insurance crisis, another hurricane-prone coastal state, Louisiana, is navigating its own insurance troubles.

The Louisiana property insurance market has been deteriorating since the state was hit by a record level of hurricane activity during the 2020/2021 seasons.

While similarities exist between the situations in these two hurricane-prone states, the underlying causes of their insurance woes are different in important ways

Mark Friedlander, Triple-I’s director of corporate communications

Florida’s problems are largely rooted in decades of litigation abuse and fraud, whereas Louisiana’s troubles have had more to do with insurers being undercapitalized and not having enough reinsurance to withstand the claims incurred during the record-setting hurricane seasons of 2020 and 2021 (see How Florida’s Insurance Market Could to Respond to a Repeat of a Category 5 Hurricane Andrew?).

Insurers have insured losses from over 800,000 claims filed from the two years of heavy hurricane activity. The largest property loss events were Hurricane Laura (2020) and Hurricane Ida (2021).

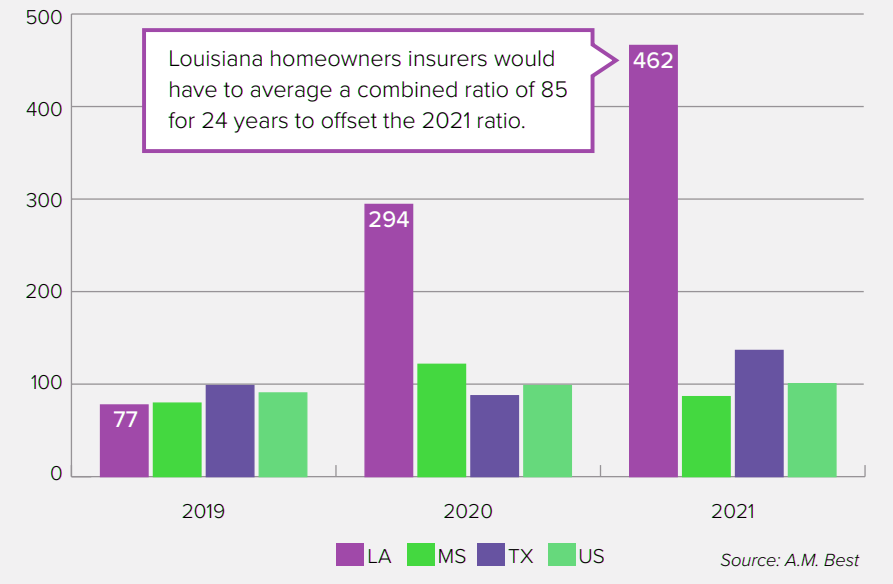

Direct combined ratios for homeowners insurance writers in each state

The growing volume of losses also drove a dozen insurers to voluntarily withdraw from the market and more than 50 to stop writing new business in hurricane-prone parishes.

Louisiana Citizens Property Insurance Corp. – the state-run insurer of last resort – has grown from 35,000 to 128,000 policyholders over the past two years, according to the Louisiana Department of Insurance.

Florida’s and Louisiana’s insurance challenges intersect in that several regional insurers operate in both states. Four Florida companies that were declared insolvent – FedNat Insurance Co., Southern Fidelity Insurance Co., Weston Insurance Co., and UPC Insurance Co. – had a significant market presence in Louisiana. Louisiana-domiciled Lighthouse Property Insurance Corp., which the Louisiana insurance regulator declared insolvent in 2022, was headquartered in Tampa, Fla.

Louisiana’s policymakers say they are confident a $45 million fund approved in February 2023 to incentivize insurers to write business in the state will help stabilize the market, but insurance commissioner Jim Donelon acknowledged that the approved grants are only the first step toward potentially bringing down homeowners’ insurance rates.

A regular on the American Tort Reform Foundation’s Judicial Hellholes list, the state’s onerous bad faith laws contribute significantly to inflated claim payments and awards, according to a joint paper published last summer by several insurance industry trade groups.

To increase the availability and to broaden the affordability of homeowners insurance coverage, Louisiana’s lawmakers revived this year the Insure Louisiana Incentive Program.

The state authorized $45 million in matching grants for disbursement under the Program. It incentivizes new and existing Louisiana insurers to write residential and commercial insurance policies in coastal areas.

One of the Program’s other public policy goals is to reduce the number of policyholders in Louisiana’s Citizens Property Insurance Corp., the state-run property insurer of last resort.

Complicating matters further for its policyholders, Louisiana is by far the least affordable state in the U.S. for personal auto insurance, according to a 2022 study released by the Insurance Research Council (IRC).

by

by