The intensity and spread of inflation is sending insurance claims costs soaring. Strong rate hardening in US commercial property insurance lines and acceleration in personal lines rates support topline growth, but higher claims severity is eroding the profitability benefit.

Given the declining investment yields of the past decade, US property and casualty insurers’ investment allocations during this period have shifted to more riskier assets such as lower-rated and private placement bonds.

According to AM Best, that bonds remain the foundation of P&C insurers’ investment portfolios, but allocations have been declining.

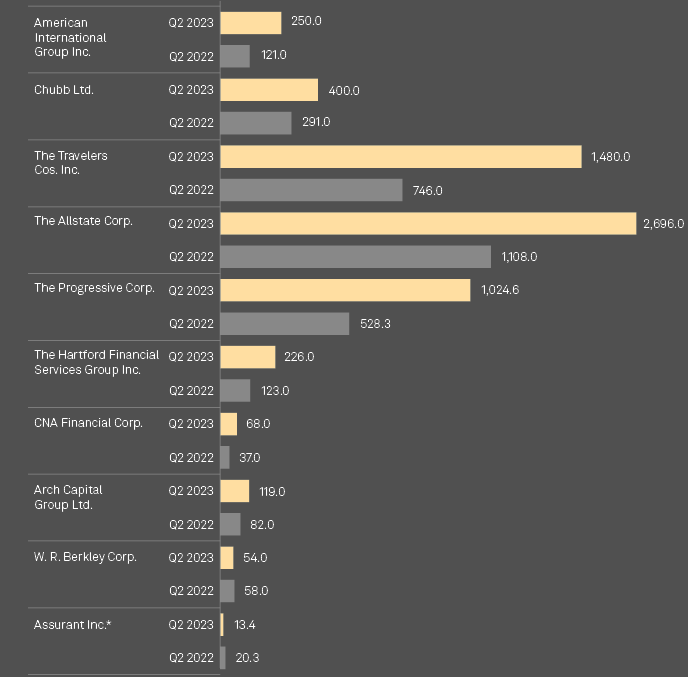

Catastrophe losses mount up

It was the fifth straight quarter in which Allstate booked losses in pretax income and operating EPS and the second-consecutive quarter in which catastrophe losses exceeded $1.5 billion.

According to S&P Global report, insurer Allstate had the largest catastrophe loss load among insurers in the analysis at $2.7 billion, an increase from $1.69 billion in the first quarter of 2023. Travelers was second with a $1.48 billion catastrophe loss bill, and Progressive, whose losses totaled $1.02 billion, was third.

Catastrophe losses deal among US insurers

Light catastrophe activityand reserve releases supported underwriting results, but we continue to expect a difficult year for the industry.

According to Natural & Man-Made Catastrophe Loss Outlook, the effects of surging inflation on claims costs are only partly offset by the investment benefit from higher interest rates.

Allstate’s catastrophe losses were driven by the business that handles private personal auto and homeowners coverage. The Allstate Protection segment recorded an underwriting loss of $2.09 billion in the quarter.

Mario Rizzo, Allstate’s president of property and liability, said that the underwriting losses were caused by higher catastrophe and noncatastrophe losses from severe weather events and increased accident frequency and claim severity.

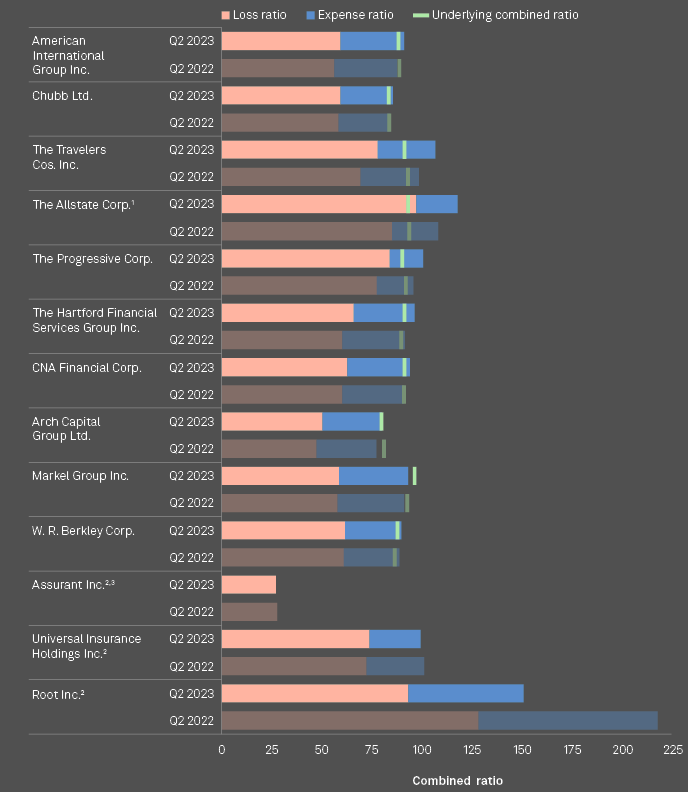

Underwriting ratios of US P&C Insurers

The $1.48 billion in catastrophe losses Travelers incurred was the insurer’s second-largest ever for a second quarter, CFO Daniel Frey said during the company’s earnings call (see Global Commercial Property & Casualty Insurance Market Review).

Six events in the quarter each surpassed the $100 million mark, the highest such total since 2013 when the company started disclosing statistics from its significant events table.

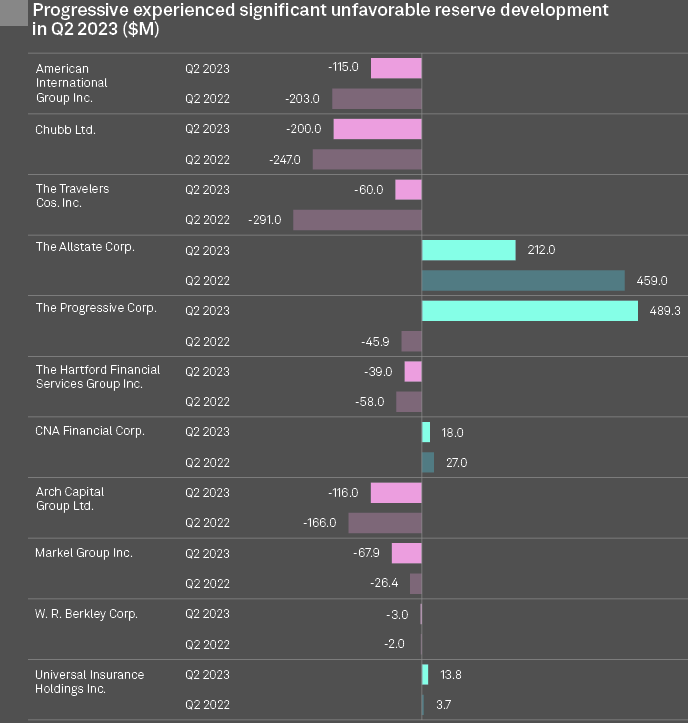

Reserve development of US P&C Insurers

Progressive’s catastrophe losses were a significant part of the insurer’s profitability pressures. 43 events through the first half of 2023 had been “broadly felt” in 44 US states

Susan Griffith, Progressive’s CEO

Those losses led to significant unfavorable reserve development for the Mayfield, Ohio-based insurer to the tune of $489.3 million, compared with favorable development of $45.9 million a year ago.

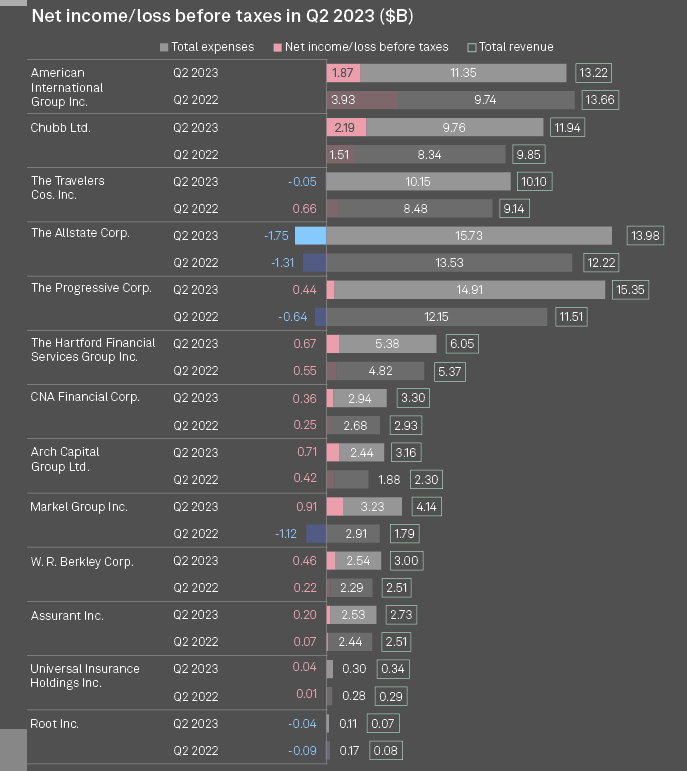

US P&C Insurance earnings recap

Allstate Corp.’s balance sheet took another heavy hit in the second quarter thanks to a combination of substantial catastrophe losses and elevated frequency and severity in its personal auto segment.

The insurer reported a net loss before taxes of $1.75 billion in the period, compared to a net loss of $1.31 billion in the second quarter of 2022.

Operating EPS plummeted to a loss of $4.42 per share from a loss of 75 cents while the insurer’s combined ratio ballooned to 117.6% from 107.9%.

Net income / loss before taxes of US P&C insurers

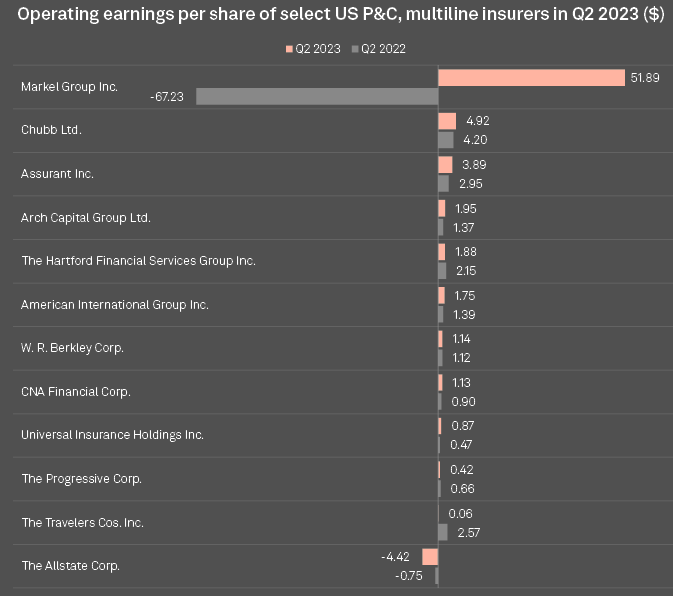

Markel Group Inc. had positive reversal in fortune in both EPS and pretax income. The Glen Allen, Va.-based carrier’s EPS soared to $51.89, from a loss of $67.23 per share in the second quarter of 2022. Pretax income rose to $908 million, from a loss of $1.12 billion a year ago.

Progressive Corp.’s pretax income also returned to positive territory in the quarter, rising to $435.7 million from a loss of $635.9 million in the prior-year period.

As interest rates rise with the Fed’s recent hikes, the coupons of current bond holdings become less attractive by comparison, affecting price and pushing the mark-to-market values of current holdings lower for GAAP filing companies.

Property/casualty carriers also have increasingly invested new money in private placement bonds—the industry has more than doubled its allocation since 2012, to 20.3% from 9.3%, with a large increase in 2021.

Operating earnings per share of US P&C insurers

U.S. P&C reinsurers wrote $32.4 bn of Gross Premiums Written during Q1 of 2023, up from $27 bn, $1.67 bn of Direct Premiums Written, and $27.3 bn of net premiums, up from $24.6 bn for the same period last year.

Losses & Loss Adj. Expenses grows to 19.9 bn. The combined ratio for the group was 95.3%, only a minor increase compared to 95.1% for the same period in 2022.

The combined ratio is attributable to a 78% loss ratio versus 73.3% for the same period in 2022, and a 17.3% expense ratio versus 21.8% for the same period in 2022.

……………..

AUTHORS: Tom Jacobs, Hassan Javed – S&P Global Intelligence analysts