Clyde & Co, in partnership with Winmark, surveyed over 200 business leaders to explore the risk landscape that corporates face, understand how well-equipped they are to navigate it successfully, and what steps they are taking to manage risk and maximise opportunity.

The three risks leaders feel least prepared for are geopolitical, climate change risk and societal risks.

Political instability, rising inflation, increasing interest rates and declining investment have all underlined how volatile and unpredictable the economic and geopolitical environment has become.

To understand how business leaders are addressing this daunting situation, we have consulted over 200 Board Directors and CEOs, General Counsel (GCs) and other senior C-Suite executives from multiple sectors and across all global regions (see Main Challenges for Insurance Industry).

Clyde & Co have achieved, by some margin, the largest sample size in the study’s history and are extremely grateful to all the respondents who have engaged so enthusiastically with the research and shared their knowledge and experiences (see 10 Most Important Global Business Risks for 2023-2024).

They have provided us with invaluable insight into the priorities and plans of those who are on the front lines of analysing, managing, and minimising the impact of business risks.

The report delves into the risk landscape and has identified economic risk, people challenges, and increased regulatory and compliance burden as the top three challenges organisations currently face.

While the pandemic is receding as a primary concern for organisations, the aftermath of COVID-19, along with disruptions caused by the war in Ukraine, has led to supply shortages and growing economic risks such as debt, interest rate increases, and the spectre of a prolonged recession.

These circumstances have led to the return of risks that many current business leaders will not have experienced before, such as high inflation, trade wars and geopolitical tensions that pose a threat of nuclear conflict.

The new and emerging economic and geopolitical challenges have added to the scale and complexity of the risk landscape rather than shifting risk from one area to another.

The global risk landscape

The regulatory environment is the third biggest risk area overall, and second biggest for GCs. Organisations are finding it difficult to stay abreast of often complex regulatory changes and the associated time, costs and resources needed to ensure compliance.

Geopolitics has also risen up the hierarchy of high impact risks, from seventh to fifth place. Assessing the risk landscape is a challenge in what is arguably, the most complex and unpredictable geopolitical environment since the Second World War.

Specific worries include deterioration of relations between China and the EU/USA; the prospect of war between Taiwan and China and the escalation of the Ukraine conflict.

People challenges are expected to have the second highest impact on business. The ongoing effect of the ‘great resignation’, the increased cost of labour and the emergence of more demanding employee expectations of work culture and conditions have all contributed to continued difficulty in attracting and retaining staff.

This year sees the return of some risks that many organisations will not have experienced before, such as high inflation, trade wars and geopolitical tensions that pose a threat of nuclear conflict.

The unstable economic position is a primary concern for respondents across all roles. New and emerging geopolitical and economic factors remain a largely unknown quantity, causing uncertainty.

The economy has leapfrogged ahead of people, regulation and technology to be the business risk expected to have the biggest impact in the next two to three years. Other risks related to the economic environment have also moved up the rankings, including market competition and credit risk (see how Effective Use of Customer Data Can Help Insurers Reduce Explosure Risks).

The two most pressing economic concerns are inflation and the prospect of recession. The transition to net zero and the highly competitive labour market are also causing inflationary pressures.

Environmental and data protection regulations are both complex and subject to frequent change. Organisations are improving their risk management systems to track, monitor, and analyse market changes and assess their potential impact on the business.

If the past few years have taught us anything, it is to expect the unexpected. Businesses need to “game-theory” different types of risks that could emerge and give more credence to scenarios that are “highly unlikely” to occur.

Marc Voses, Clyde & Co Partner, US

They need to think way outside of the box – you may not always be able to apply history to the future, and you can’t devote resources to investigate everything, so businesses need to weigh the cost versus benefits of how much devote to future predictions and which areas to analyse (see how Data Allows Insurers to Manage Risk & Improve Insurance Underwriting).

Adherence to employment, tax, data privacy and workplace safety regulations have become more complex as employees more frequently work overseas, from home or in public areas such as cafes and co-working spaces.

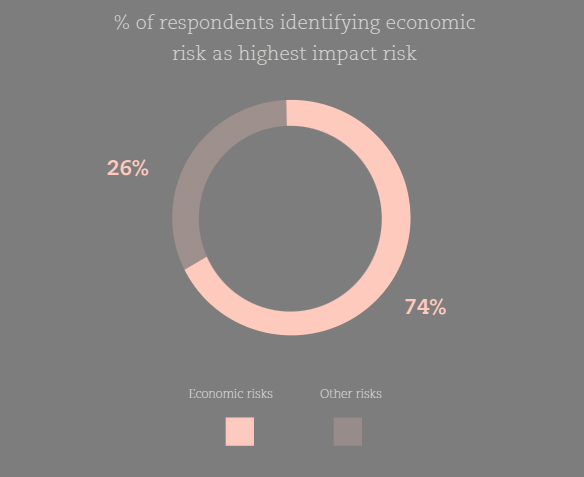

Economic risk – encompassing factors such as global economic performance, inflation, interest rates and currency volatility – has jumped to the top of the list

Last year, just 51% of respondents felt that Economic risk would have a high or very high impact on their organisations in the next two to three years. This has jumped up to 74%, rising from fourth to first place.

Geopolitical risk (e.g., trade barriers, supply chain disruption and sanctions) has also risen up the hierarchy, from seventh to fifth place.

The three risk areas that business leaders expect to have the biggest impact in the next two to three years are:

- Economic risk

- People challenges

- Regulation and compliance burden

Top risks 2022 vs 2023

Economic risk focus

Economic risk is identified as the highest impact risk (74% think it will have a high impact, and it is the top risk for Boards, GCs and C-Suite executives).

The two most pressing economic concerns are inflation and the prospect of recession. There is fear of a potential decline in demand and consumer spending, which is causing hesitation in making long-term investments or pursuing new projects.

As a result, numerous investments are being delayed or reduced in scale, as companies prioritise cost reduction and operational efficiency enhancements to navigate the ambiguous economic environment.

There isn’t a clear strategy from the UK Government that will promote growth and competitiveness

NED Chairman, Construction, UK

This is important to provide direction and confidence for investment. Key issues such as labour availability and skills, friction in supply channels and infrastructure remain significant challenges as does high levels of inflation.

People risk focus

People issues are identified as the second highest impact risk overall (51% think it will have a high impact).

Inflation is causing salaries to rise, exacerbating the existing shortage of skilled workers, and creating particular challenges for people-intensive industries.

European workforce demographics point to a continued reduction in the talent pool, leading to leveraging of global labour and an increased focus on developing and retaining internal talent.

The ongoing impact of the ‘great resignation’ is being keenly felt across many sectors. In addition, employees are becoming more demanding in their expectations regarding work conditions, with flexible hybrid workplace policies becoming the norm.

Some organisations have struggled to meet these demands whilst also maintaining productivity and establishing a strong team culture, but all respondents recognise the reality that flexibility, healthcare and childcare provisions, offering work-life balance, and employee development are all crucial tools in the battle to attract talent and maintain competitive advantage.

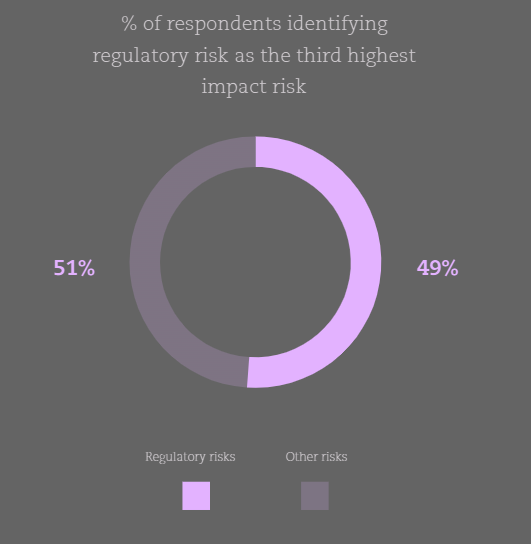

Regulatory risk focus

Regulatory risk is identified as the third placed risk overall (49%) and is in second place in the risk hierarchy for GCs (61%).

The risks of non-compliance, such as legal penalties, reputational damage, and operational disruptions, are also perceived to be increasing.

Organisations (particularly those in highly regulated sectors such as finance) are finding it difficult to stay abreast of often complex regulatory changes and the associated drain on time, costs and resources needed to ensure compliance.

Environmental and data protection regulations are both complex and subject to frequent change, and so are of particular concern.

Financial regulations designed to ensure transparency, stability, and consumer protection come with high financial and reputational risk if compliance is inadequate

Hybrid working models have had a considerable impact on compliance with labour and tax regulations and laws.

To mitigate regulatory risk, organisations are increasingly implementing and developing formal regulatory risk management systems to track, monitor, and analyse market changes and assess their potential impact on the business, and to ensure they update business policies accordingly. GRC (governance, risk management, and compliance) technology continues to be an important tool to manage this complexity.

Risk preparedness

The top three risks that leaders feel least prepared for remain unchanged – however Geopolitical risk has moved from third place to top place, again underlining the fact that macro-level geopolitical risks are higher on the radar of leaders this year.

Geopolitical risk focus

Geopolitical risk, along with Economic risk, has risen up the ‘high impact’ hierarchy, and is now in fifth place, up from seventh – it is of particular concern for Board and C-Suite executive respondents.

Proactively assessing the risk landscape and carrying out horizon scanning is now seen as an increasingly vital aspect of all senior roles – GC, Board and the rest of the C-Suite – but is a real challenge given that the current geopolitical environment is arguably more complex and unpredictable than at any time since the Second World War.

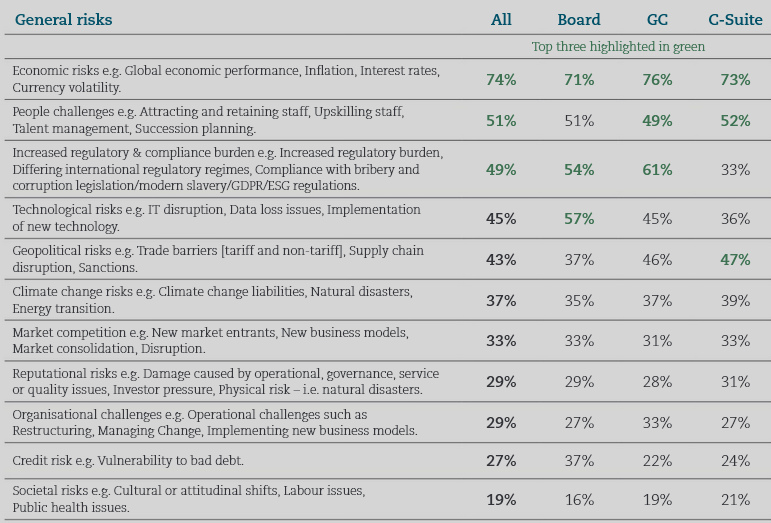

% respondents identifying each risk as expected to have a high or very high impact on their organisations

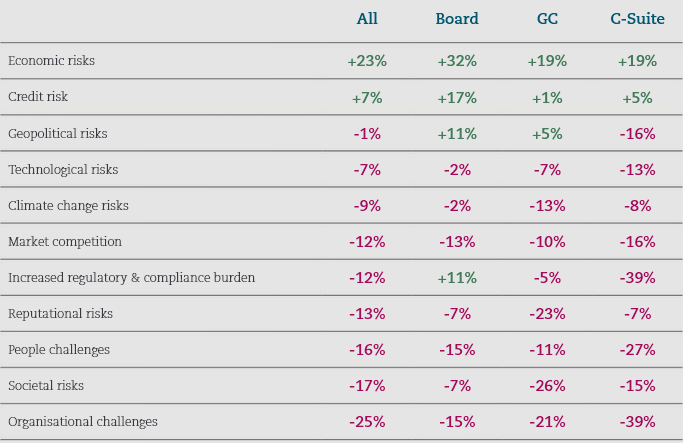

The top three risks for each group are highlighted in green, and show that respondents in Board, GC and C-Suite executive roles broadly agree on the risk priorities they will need to address in the next two to three years.

Change in % respondents identifying risk as having a high or very high impact on their organisations

As noted in the following table, the standout change this year is an increase in perceived impact of ‘Economic risk’ which is up by 23% overall (+19% with GCs, +32% with Board respondents and +19% with C-Suite execs).

Macro-risks associated with geopolitical and economic circumstances are perceived as having greater impact in the future, whereas the priority of micro-risks of a more operational or internal nature – such as people risk and organisational risk – have reduced.

In the EU, new ESG reporting requirements have been much more work than many expected because ESG is so broad. It’s not just about climate change and sustainability, but concerns around human rights and the supply chain etc.

Eva-Maria Barbosa, Clyde & Co Partner, Germany

Moreover, the details on technical standards are coming out very late. All this puts intense pressure on legal and compliance departments.

Regulators are now much more sophisticated than ever before and they’ve ramped up their teams enormously. After Wirecard and Greensill, they’re increasing their scrutiny on firms and that’s palpable. Audits are becoming much more frequent and investigations more demanding, with less time or notice given to provide information or solve any issues.

With so many pressures being brought to bear on companies in the current climate, there are real questions over whether they have a well-functioning compliance and risk management system. Being able to react to any risk that is thrown at you requires a big team and significant investment in robust systems that must be amended on a continuous basis to be fit and proper.

……………………

AUTHORS: Eva-Maria Barbosa, Marc Voses, Franco Acchiardo, Rachel Cropper-Mawer, Rebecca Ford, Avryl Lattin, Ton van den Bosch, Simon Vere Nicoll, Heidi Watson, Dino Wilkinson – Partners at Clyde & Co